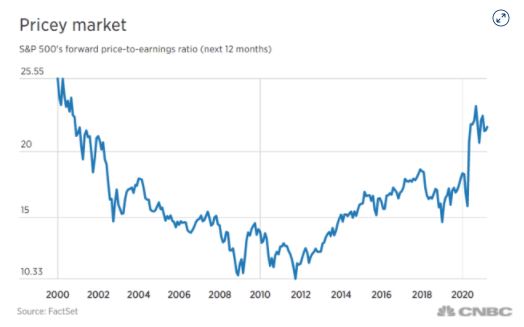

It’s Different This Time…Until It’s Not (Like 2000 and 2007)

It’s Different This Time… Start a free trial of The Sevens Report.

What’s in Today’s Report:

- It’s Different This Time… Until It’s Not (Like ’00 and ’07)

- Chart – Visualizing Where We Are in the Market Cycle

Stock futures are trading with a slight bias to the downside as inflation data overseas showed an uptick in price pressures ahead of the latest Fed minutes release today.

Economically, Hong Kong CPI rose to 2.7% vs. (E) 2.1% in October marking the first “warm” inflation print in months. There were several one-off factors influencing the increase in price pressures but the “hot print” was a reminder that the global inflation fight is not officially over just yet.

Looking into today’s session, there is one economic report to watch: Existing Home Sales (E: 3.91 million) and if it comes in strong, that could weigh on Treasuries (yields higher) and in turn pour some cold water on stocks.

There is another Treasury auction today at 1:00 p.m. ET, but this one is for 10-Yr TIPS and will likely receive less attention than yesterday’s 20-Yr Bond auction, limiting its market impact.

From there focus will turn to the release of the minutes from the November FOMC meeting at 2:00 p.m. ET. Any language that is more hawkish than the currently very dovish shift in policy expectations could also trigger a pullback in equities in thinning holiday week trading today.

Finally, although earnings season is effectively over, there is one notable release today as NVDA ($3.18), one of the “Magnificent Seven” mega-cap tech stocks that have led the market higher in 2023, will report results after the close.

Join hundreds of advisors from huge brokerage firms like Morgan Stanley, Merrill Lynch, Wells Fargo Advisors, Raymond James, and more! To start your quarterly subscription and see how The Sevens Report can help you grow your business, click here.