What’s in Today’s Report:

- PPI and Jobless Claims Strengthen the “Goldilocks” Narrative

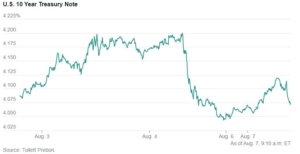

Futures are little changed following a quiet night of news as markets digest the Wed/Thurs rally and focus turns to the start of the Q2 earnings season.

Economically, there was more evidence of global disinflation (or deflation) as German Wholesale Prices (think their PPI) declined –2.9% y/y vs. (-1.2%) y/y.

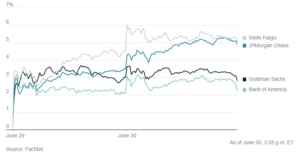

Today focus will be on earnings, as we get several major bank earnings results: JPM ($5.92), C ($1.31), WFC ($1.15), and BLK ($8.47) as well as UNH ($5.92). These large cap companies usually don’t provide too many surprises in their earnings reports, but markets will want to hear positive commentary on the overall environment to further support this latest rally in stocks.

There are also two notable inflation linked economic reports today, Import & Export Prices (E: -0.2%, -0.4%), Consumer Sentiment (E: 65.0), but barring any major surprises they shouldn’t move markets.