What the Bank Failures Mean for Markets

What’s in Today’s Report:

- What’s Happened with the Bank Failures

- What the Government Response Means for Markets

- Is This A Bearish Gamechanger?

- CPI Preview

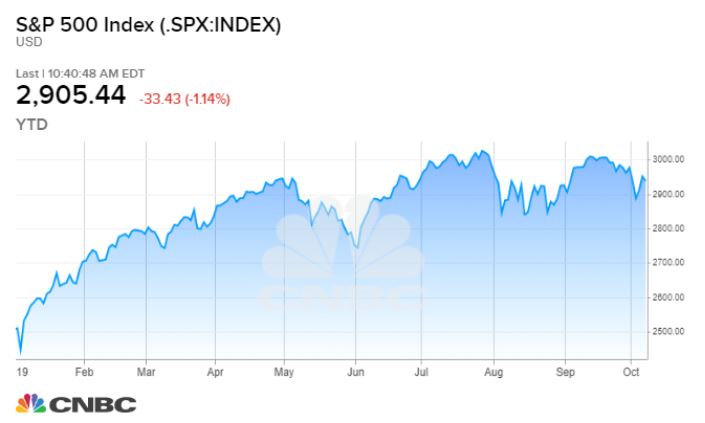

Futures are little changed as markets digest the three bank failures last week and the government response.

Silicon Valley Bank (SVB) and Signature Bank of New York (SBNY) both failed over the weekend, making three bank failures last week. In response to the SVB and SBNY failures, the government announced the creation of a bank lending facility, the Bank Term Funding Program, which is helping to ease concern about a broader bank run (but doesn’t entirely solve the crisis).

Today President Biden will address the nation on the situation this morning, but the key remains stability in the regional banks and in Treasury yields (they need to stop collapsing). If regional banks (KRE) and yields stabilize, markets can rally.