How to Explain the Israel-Hamas Conflict to Clients

How to Explain the Israel-Hamas Conflict to Clients: Start a free trial of The Sevens Report.

What’s in Today’s Report:

- How to Explain the Israel-Hamas Conflict to Clients (How It Matters to Markets)

- Empire State Manufacturing Index Takeaways (More Goldilocks Data)

Stock futures are modestly lower this morning as Treasury yields are rising back towards cycle highs. This is on news that President Biden will travel to Israel tomorrow to try and ease tensions in the region.

Economic data was largely shrugged off overnight. There were more signs of disinflation as wage pressures eased in the latest U.K. Labour Report. While New Zealand’s latest CPI report undershot estimates at 5.6% vs. (E) 5.9% year-over-year.

Today is lining up to be a busy session news-wise as we get several economic reports in the U.S. including: Retail Sales (E: 0.3%), Industrial Production (E: 0.0%), Business Inventories (E: 0.3%), and the Housing Market Index (E: 45). Investors will want to see more Goldilocks data supporting both peak-Fed-hawkishness and prospects for a soft economic landing in order for stocks to continue to rally.

There are also multiple Fed speakers to watch: Williams, Bowman, Barkin, and Kashkari. Markets will be looking for more commentary that suggests the FOMC is done with rate hikes for the cycle.

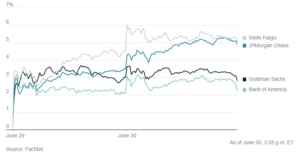

Finally, earnings season continues to ramp up with: BAC ($0.80), GS ($5.32), JNJ ($2.52), and LMT ($6.66) reporting results before the bell. While UAL ($3.40) and JBHT ($1.87) will report after the close. A drop-off in earnings is not priced into markets at these levels so investors will be looking for positive quarterly results and upbeat guidance.

Join hundreds of advisors from huge brokerage firms like Morgan Stanley, Merrill Lynch, Wells Fargo Advisors, Raymond James, and more! To start your quarterly subscription and see how The Sevens Report can help you grow your business, click here.