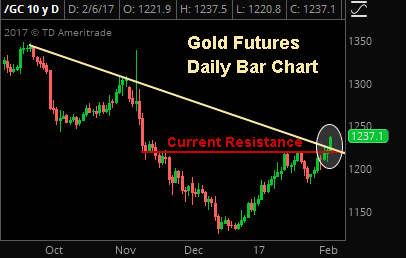

Gold Update

/in Investing/by Tyler RicheyGold futures violated a longstanding downtrend resistance line yesterday as well as established above the $1235 resistance area; two bullish technical developments.

Key Gold Resistance Level

/in Investing/by Tyler RicheyGold has rebounded solidly this year but continues to stall at key resistance between $1220 and $1235. Until futures establish above that level, the outlook remains neutral with a downside bias.

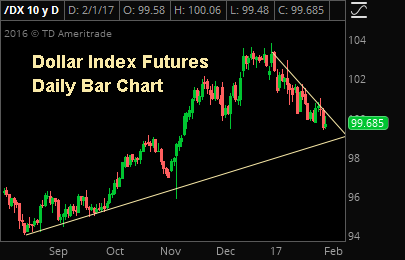

Dollar Downtrend

/in Investing/by Tyler RicheyNear term, the dollar index is in a steep down trend that began at the turn of the year. Longer term however, the broader trend in the market remains a bullish one for now.

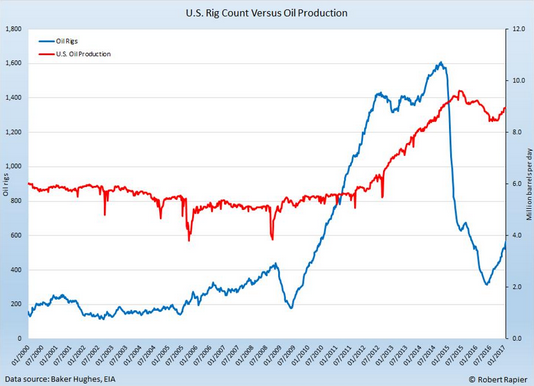

The Oil Market: Then and Now

/in Investing/by Tyler RicheyThe Oil Market: Now and Then We have included in today’s report a chart that was featured in a Forbes article yesterday regarding the two main influences on the oil market right now: rising US output and OPEC/NOPEC production cuts. At first look, the chart suggests that using hindsight as a gauge, US production lags […]

Crude Oil Breakout

/in Investing/by Tyler RicheyWTI crude oil futures broke out of a multi-week trading range yesterday and closed just shy of a new 2017 high as a sellers-strike continues ahead of data releases that could confirm (or discredit) proposed global output cuts.

Stock Market Update: January 26, 2017

/in Investing/by Tyler RicheyHere is a “Stock Market Update” from The Sevens Report: Stocks finally moved Tuesday, as the S&P 500 staged a modest rally following good economic data and well received (but not really positive) political headlines. The S&P 500 rose 0.66%. Stocks were flat to start Wednesday trade thanks to generally “ok” economic data from Europe […]

Trade War 2.0 Primer (Needed Context)

/in Investing, Reports/by Tom EssayeWhat’s in Today’s Report: U.S. Trade Primer (Needed Context for Trade War 2.0)