Jobs Report Preview, June 1, 2017

/in Investing/by Tom EssayeFor a second-straight month, the risks to tomorrow’s jobs report are balanced. A “Too Hot” number will increase the possibility of more than three rate hikes in 2017 while a “Too Cold” number will fan worries about the pace of economic growth, and the ability of economic growth to push stocks materially higher from current […]

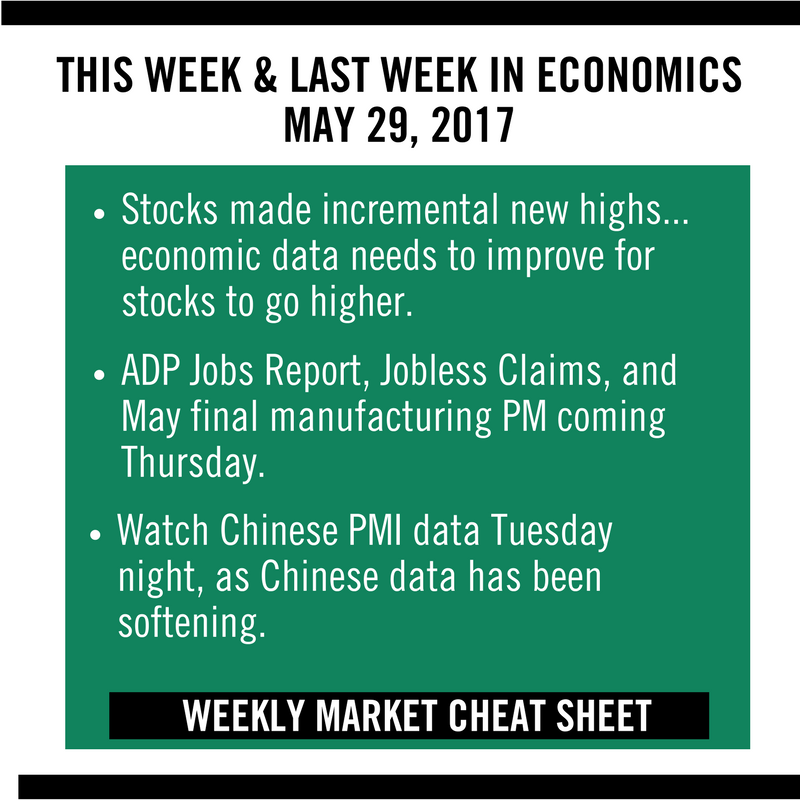

Weekly Market Cheat Sheet, May 29, 2017

/in Investing/by Tom EssayeThe Sevens Report is the daily markets cheat sheet our subscribers use to keep up on markets, leading indicators, seize opportunities, avoid risks and get more assets. Get a free two-week trial with no obligation, just tell us where to send it. Last Week in Review: Economic data continued to underwhelm last week, and while […]

OPEC (and NOPEC) Meeting Takeaways, May 26, 2017

/in Investing/by Tom EssayeHelp your clients outperform markets with The Sevens Report. Get a free two-week trial—start today. Oil trade over the last week was a classic case of “buy the rumor, sell the news,” as the speculative rally that carried WTI up to the $52 mark came completely unwound yesterday after OPEC announced that they would extend […]

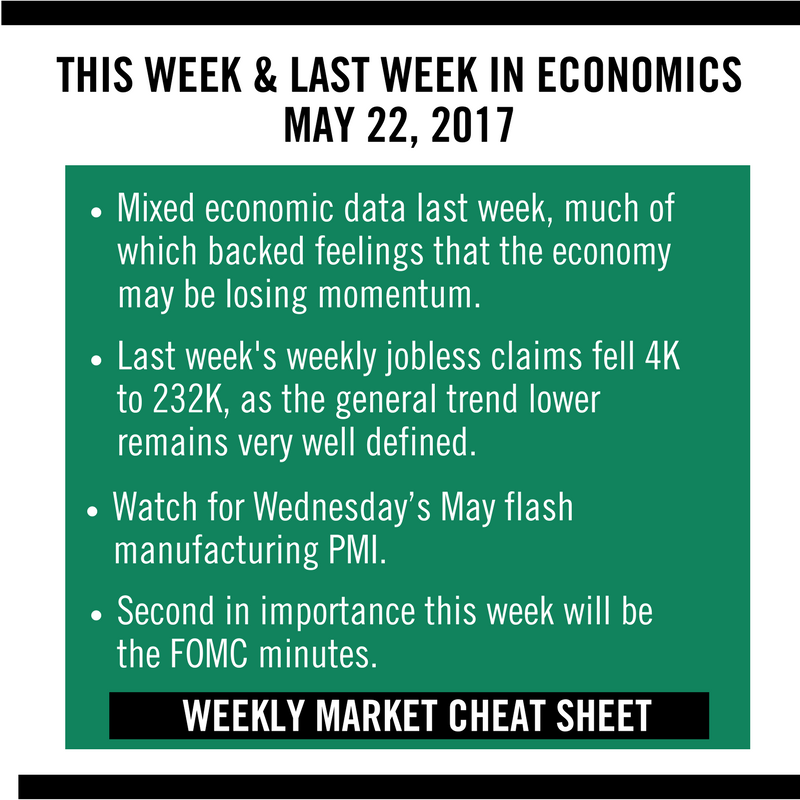

Weekly Market Cheat Sheet, May 22, 2017

/in Investing/by Tom EssayeThe Sevens Report is the daily markets cheat sheet our subscribers use to keep up on markets, leading indicators, seize opportunities, avoid risks and get more assets. Get a free two-week trial with no obligation, just tell us where to send it. Last Week in Review: There weren’t many economic reports last week, and the data we […]

Tom Essaye on “The Bell” Podcast with Nick Colas and Adam Johnson

/in Investing/by Tom EssayeThanks to Adam Johnson for having me on his podcast “The Bell” again last week. We talked with Nick Colas, Chief Strategist at Convergex (Wall Street’s Malcolm Gladwell), about VIX, and high volatility. What does it mean when the VIX is so low, what’s being shorted, and what’s happening with the Chinese economy? Get a free two-week trial […]

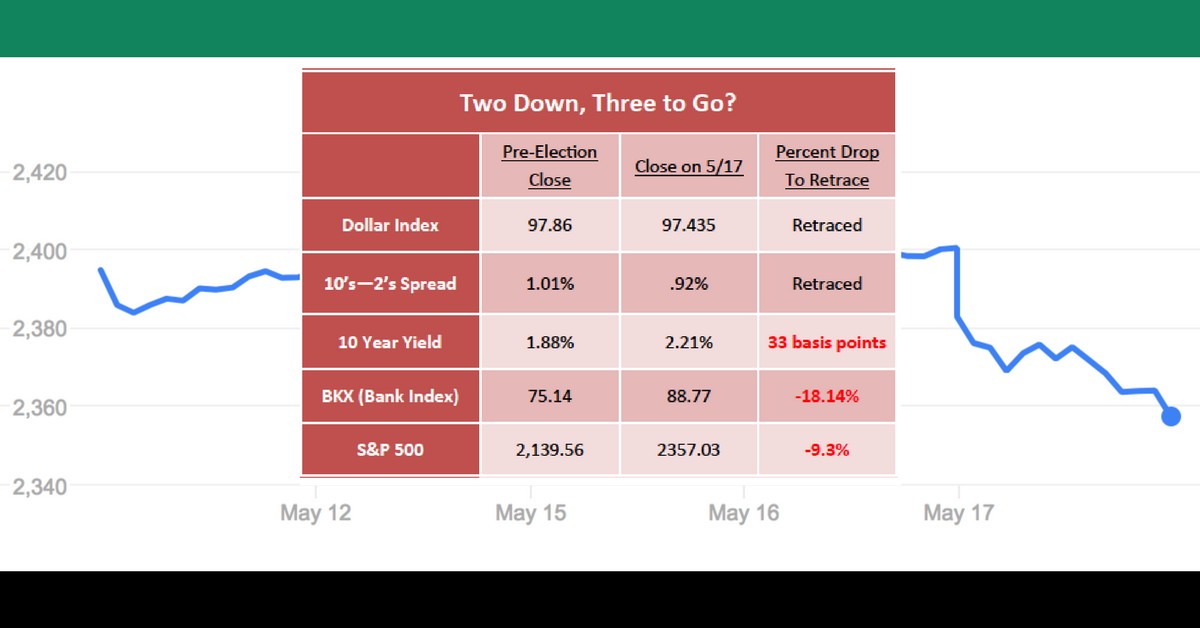

Two Markets Down, Three to Go?, May 18, 2017

/in Investing/by Tom EssayeThe Sevens Report is everything you need to know about the markets in your inbox by 7:00am, in 7 minutes or less. You can start your free two-week trial today and see how much smarter the Sevens Report makes you. The most important trading across markets Wednesday was not in the stock market, it was […]

Earnings and economic growth are still solid

/in Investing, Reports/by Customer Service“Earnings and economic growth (the two most important foundational forces for stocks) are still solid,” the analysts wrote.