Don’t Fight the Fed (Still)?

What’s in Today’s Report:

- Should We Buy LQD Now that the Fed Is Buying It Too?

Futures are staging a rebound this morning after yesterday’s late day plunge in stocks as tensions between the U.S. and China simmer while investors weigh the risk-reward dynamics of reopening global economies.

Economic data remained fairly dismal overnight but not as bad as feared with U.K. Monthly GDP dropping -5.8% vs. (E) -7.0% while EU Industrial Production fell -11.3% in March vs. (E) -12.0%. Despite the data topping estimates British 2-Yr yields notably fell to a record low of –0.045%.

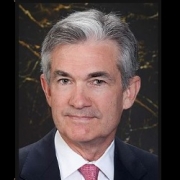

Today there is just one economic report due out ahead of the open: PPI (E: -0.5%) and it shouldn’t materially move markets especially with investors primarily focused on Fed Chair Powell’s virtual participation in a webcast at 9:00 a.m. ET that will include a Q&A session at the end.

The only other catalyst on the calendar is a 30-Yr. Bond auction by the Treasury at 1:00 p.m. ET. As we saw yesterday, the very strong demand for 10 Yr. Notes pressured yields and weighed on stocks in the early afternoon and we could potentially see a repeat of that today.