Updated Near-Term Market Outlook

What’s in Today’s Report:

- Updated Near-Term Market Outlook

- Weekly Economic Cheat Sheet

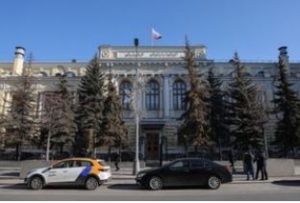

U.S. stock futures are trading higher with European shares amid renewed hopes of a ceasefire in Ukraine while Asian markets declined overnight on new Covid-19 lockdowns.

Geopolitically, Russia continued with aggressive military attacks against Ukraine over the weekend but diplomatic negotiators noted solid progress in ceasefire discussions which is helping risk assets bounce this morning.

There are no economic reports today and no Fed officials are scheduled to speak.

The Treasury will hold an auction for both 3-month and 6-month Bills at 11:30 a.m. ET today which may shed some light on the market’s current outlook for near-term Fed policy. And if shorter duration rates rise in the wake of the auctions, that could weigh on stocks as the Fed meeting comes into focus.

Bottom line, markets are still very much focused on Russia and Ukraine right now and for stocks to meaningfully bounce today, we will need to see real progress towards a ceasefire. Conversely, a deteriorating situation in Ukraine could see stocks retest multi-month lows to start the week today.