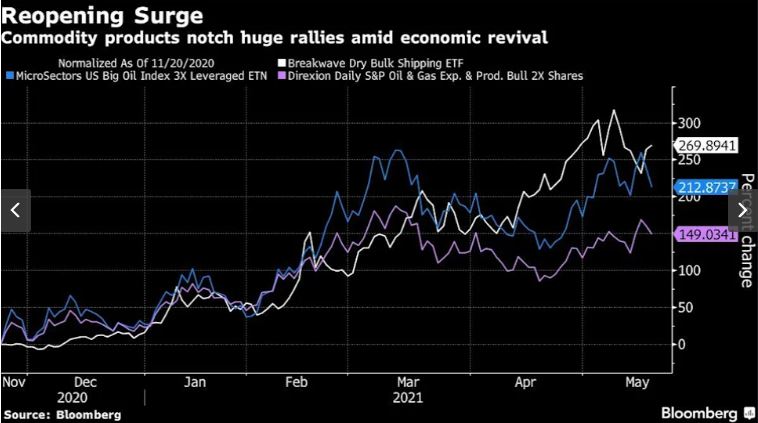

Sevens Report Co-Editor Tyler Richey Quoted in MarketWatch on May 24, 2021

Oil prices up sharply as U.S. official raises doubt that Iran will comply with nuclear commitments

“The general optimism about the economic reopening process, especially in the U.S.,” buoyed all risk assets Monday, “especially oil and refined products as traders look ahead to the unofficial start of the summer driving…” said Tyler Richey, co-editor at Sevens Report Research. Click here to read the full article.