What’s in Today’s Report:

- Is A Trade Truce a Bullish Gamechanger? No. Here’s Why.

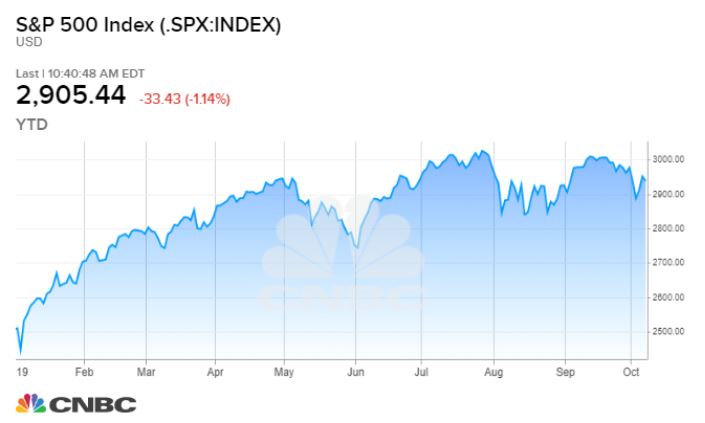

It’s green on the screen and futures are 1% higher as optimism for a U.S./China trade truce surged after the close.

President Trump said talks went “very well” yesterday and will meet Liu He in the White House at 2:45 p.m. today and a trade “truce” with no more additional tariffs is expected.

Economically, the only notable number was German CPI, which met expectations at 1.2% yoy.

Markets will be focused on any trade headlines as that’s clearly the most important topic today. From a timing standpoint, I’d expect some sort of announcement on the outcome of the negotiations between lunchtime and the close, as Trump is meeting with He at 2:45 p.m. At this point, a trade truce with some elimination of pending tariff increases is fully expected and anything less would be a disappointment.

Away from trade, we get Import & Export Prices (E: -0.1%, 0.0%) as well as Consumer Sentiment (E: 92.0), but unless the later is very bad, neither number should move markets. There are also several Fed speakers today including Kashkari (8:00 a.m. ET), Rosengren (1:15 p.m. ET) and Kaplan (3:00 p.m. ET) but none of them should move markets.