What’s in Today’s Report:

- What the Fed Decision Means for Markets (Positive, But Not a Silver Bullet)

Futures are lower following disappointing headlines on U.S. stimulus progress, combined with profit taking ahead of multiple important market catalysts coming today.

U.S. stimulus bill talks were said to be at an “impasse” late Wednesday, and that’s weighing on sentiment (although this drama is to be expected, as we cautioned last week, and a deal is still very much expected by mid- August).

Economically, German Q2 GDP missed estimates (-10.1% vs. (E) -9.4%), which is a reminder just how much damage was inflicted on the global economy in Q2.

As mentioned, one of the reasons futures are weaker this morning is book squaring ahead of several important economic and earnings events today.

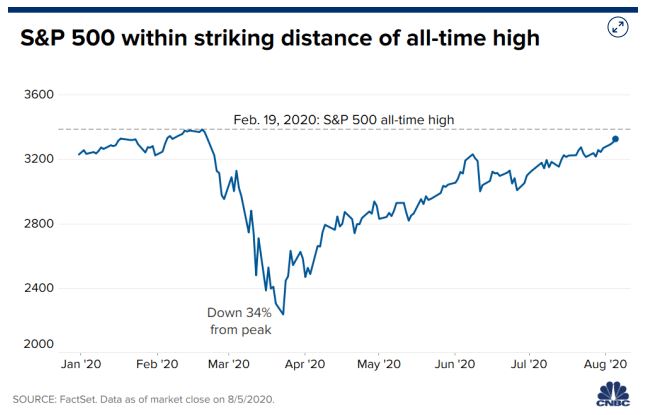

First, the most important economic report of the day is Jobless Claims (E: 1.38M). We address this more in the Report, but there are growing signs the U.S. economic recovery is pausing or stalling, and that’s not priced into stocks above 3200 in the S&P 500. If we see another notable increase in weekly claims (say through 1.5M) that will amplify fears the recovery is stalling and likely weigh on stocks.

Then, on the earnings front, we get four of the most important stocks in the market announcing results after the close: AMZN (E: $1.75), AAPL (E: $1.99), FB (E: $1.44), GOOGL (E: $8.43). The earnings results will be “fine” but these stocks have had huge runs, and if they disappoint vs. elevated expectations, just due to these stocks weights in the S&P 500, it could pressure markets after hours.

Finally, today we will get the initial look at Q2 GDP, and it will be historic as it’s estimated to be -35% seasonally adjusted annual rate (remember GDP is usually around 2% saar). I never in my life thought we’d see such a number, and I hope we don’t ever see it again. But, today history will be made as the worst GDP print ever.