What’s in Today’s Report:

- Why Did the Hong Kong Protests Cause a Drop in Stocks?

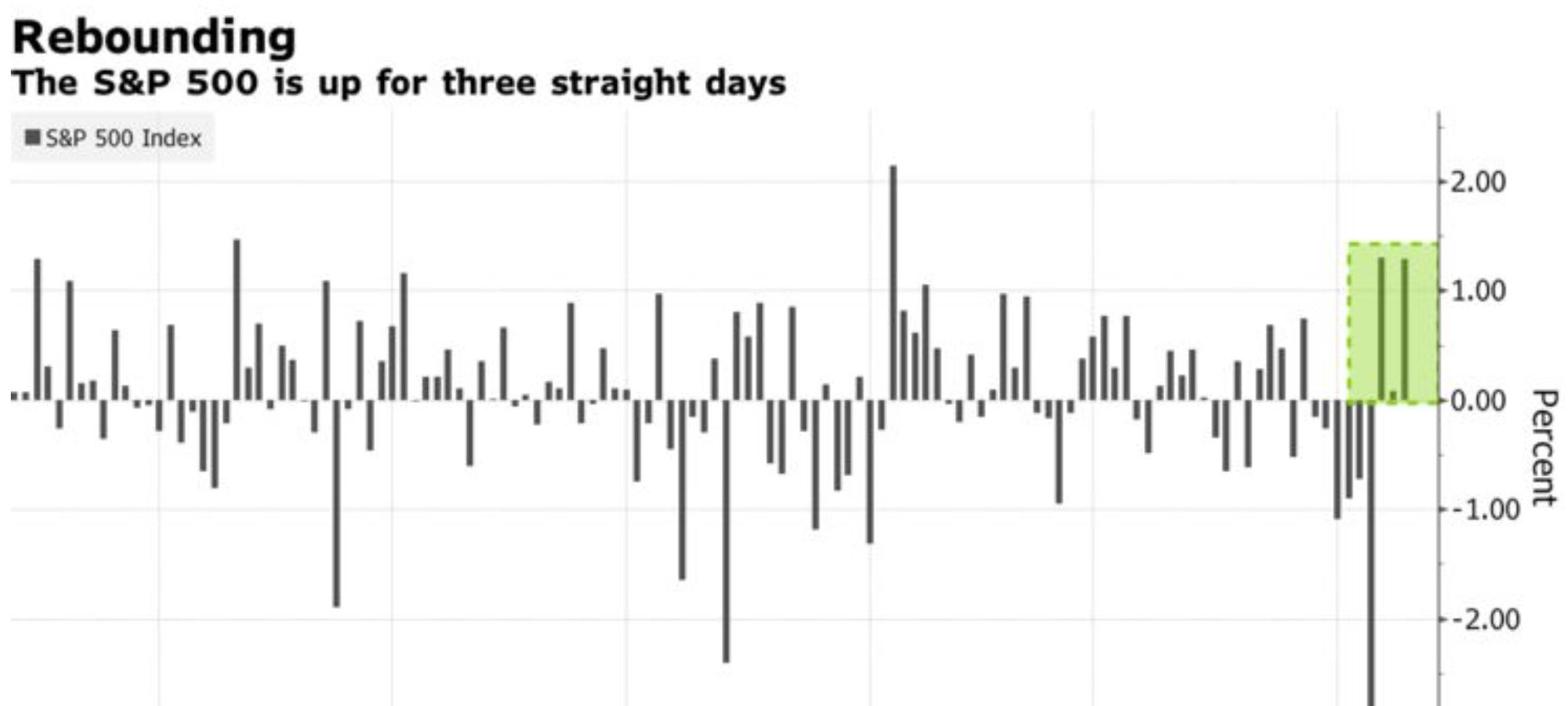

Futures are in the red and Treasury yields are extending the week’s declines amid continued unrest in Hong Kong, growing fears of a financial crisis in Argentina, and more broadly, rising concerns about the global economy.

The German ZEW Survey was terrible with Business Expectations hitting a 2011 low of -44.1 while the U.S. NFIB Small Business Optimism index was a modest upside surprise with the headline beating expectations at 104.7.

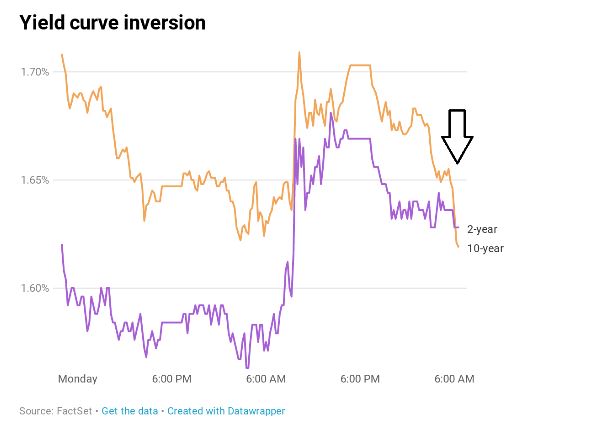

The most notable moves this morning are in the bond market where the 30-Yr Treasury is threatening to open with a record low yield below 2.10% while the 10s-2s spread fell below 5bp earlier this morning underscoring the risk-off money flows across asset classes. Gold is also notably up well over 1.5%, trading at fresh multi-year highs.

Today, the focus will remain on the crowded macro landscape as the market has been largely driven by overly cautious investor sentiment over the past few days however there is one economic report to watch ahead of the bell: CPI (E: 0.2%).

Bottom line, if headlines remain negative regarding Hong Kong, Argentina, and global growth, then it will be very difficult for stocks to rally today.