Stimulus Update (Progress Is Being Made)

What’s in Today’s Report:

- Stimulus Update

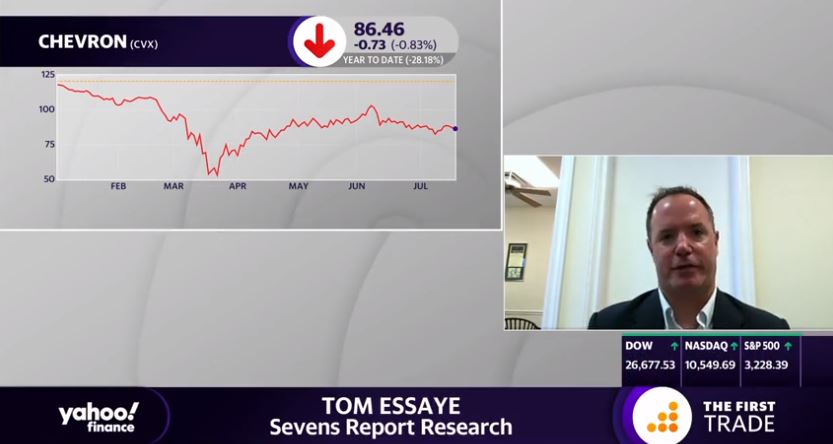

- Weekly EIA/Oil Market Update (Can the Rally Continue?)

Futures are modestly higher thanks to stronger than expected earnings and progress on the stimulus front.

TSLA earnings beat lofty expectations and the stock rallied after hours, while the rest of the major earnings reports (MSFT/CMG) were generally in-line (i.e. no disasters).

Republicans apparently reached a consensus on their version of next stimulus bill, so progress continues and a new stimulus bill is expected in the next few weeks.

Today the key number will be weekly jobless claims. There are rising fears that the U.S. economy is plateauing after the recovery in May/June, and if weekly claims move back towards, or through 1.5M, that will likely spook markets and imply that the recovery is stalling. Regarding earnings, the two reports we’re watching are T ($0.78), AAL (-$6.40), but earnings shouldn’t move markets toda