What’s in Today’s Report:

- Market Multiple Levels: S&P 500 Chart (Unbranded PDF Available)

- Why Did Small Caps Surge?

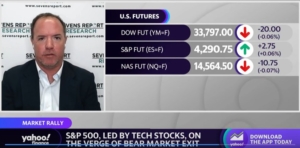

Stock futures are little changed in premarket trade indicating this week’s digestive churn sideways could continue today following mixed economic data overnight.

Chinese exports dropped -7.5% vs. (E) +1.0% year-over-year in May adding to worries about the health of the recovery in the world’s second largest economy.

Conversely, in Europe, German Industrial Production jumped 1.8% vs. (E) 1.4% y/y helping ease some worries about the health of the EU economy.

Looking into today’s session, the list of potential catalysts remains light as there are just two economic reports to watch: International Trade in Goods and Services (E: -$76.0B) and Consumer Credit (E: $21.0B) while there are no Fed officials scheduled to speak.

That will leave focus on market internals and whether or not the early June money flows into cyclicals and small cap stocks can continue. If so, the improving breadth in the market with the S&P 500 sitting just under YTD highs will add to the case that the 2023 rally is sustainable.