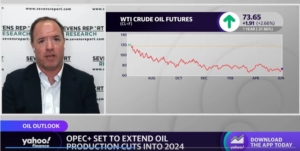

Sevens Report Co-Editor Quoted in MarketWatch on June 9th, 2023

U.S. oil futures fall for the session, lose more than 2% for the week

Prices had started the week moving higher after Saudi Arabia said it would cut output by an additional 1 million barrels per day in July. However, “traders faded the move,” as the Saudi cut would only remove one-third of a single day’s worth of global oil production over the course of July, said Tyler Richey, co-editor at Sevens Report Research. Click here to read the full article.