Economic Breaker Panel: August Update

What’s in Today’s Report:

- Sevens Report Economic Breaker Panel – August Update

- Consumer Confidence Data Points to Stagflation – Chart

Futures are trading near record highs this morning after mostly disappointing economic data helped reinforce dovish expectations for global central bank policy overnight.

Economically, a private Manufacturing PMI in China showed factory activity fell into contraction last month while European PMI data underwhelmed versus estimates and German Retail sales fell 5.1% vs. (E) -0.9% in July.

Looking into the U.S. session, focus will be one economic data early with the ADP Employment Report (E: 500K) due out ahead of the bell and then the ISM Manufacturing Index (E: 59.0) and Construction Spending (E: 0.3%) reports due shortly after the open.

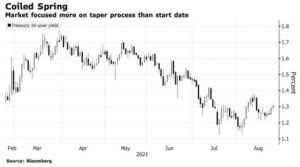

There are no Fed speakers or Treasury auctions today so the biggest driver of markets will likely be the reaction to the economic data and what it means for Fed policy expectations. The biggest risk to the rally into the end of the week is data that is “too hot” and causes a hawkish shift to a currently very accommodative Fed policy outlook.