Stock Market Update: January 10th, 2017

Stock Market Update excerpt from the Sevens Report: Stocks gave back most of Friday’s gains on Monday thanks mostly to digestion of last week’s rally ahead of some important catalysts later this week (Trump’s speech Wednesday specifically). A sharp drop in oil also weighed on the averages. The S&P 500 fell 0.35%.

Stocks started Monday mostly flat following a quiet weekend. There were actually macro positives yesterday, primary of which was the Chinese currency reserve data. But economic numbers from Germany were also strong Monday morning.

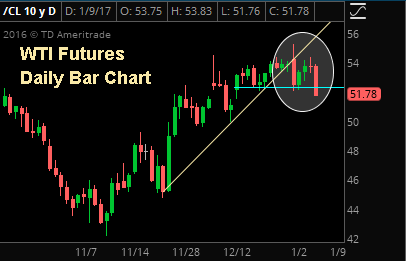

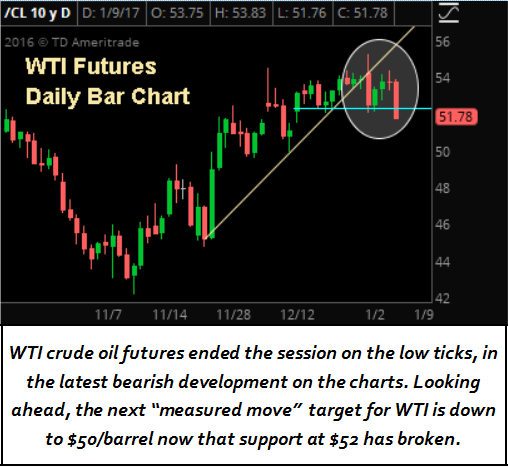

Then a drop in oil offset those positives, and as a result stocks opened lower and fell basically to the lows of the day within the first 30 minutes of trade, again thanks almost entirely to oil.

From those lows, stocks basically traded sideways for the remainder of the session. There were potential catalysts including Fed speakers and the Consumer Credit number at 3:00 p.m. yesterday, but none of it provided any material surprises, and nothing changed the general outlook for markets. Stocks chopped sideways in the afternoon before closing near the lows of the day.

Stock Market Update: Trading Color

Healthcare and super cap internet stocks were again the positive story yesterday, and five trading days into 2017 they are the clear surprise winners so far.

Healthcare and super cap internet stocks were again the positive story yesterday, and five trading days into 2017 they are the clear surprise winners so far.

Healthcare was the lone positive SPDR yesterday, rising 0.42% again mainly on biotech strength. Meanwhile, super cap internet stocks (think FANG—FB/AMZN/NFLX/GOOG) rallied again yesterday and FDN, our preferred super cap internet ETF, rose 0.25%.

Away from healthcare and internet names, selling was broad yesterday as eight of the nine SPDRs we track declined. Energy was an obvious laggard due to the drop in oil, as XLE fell 1.45%. Oddly, utilities also fell sharply (down 1.3%) despite the decline in bond yields.

Financials, industrials and consumer staples all relatively lagged the S&P 500, but didn’t fall by more than 1% while tech was again another relative outperformer, with XLK down fractionally.

Single stock news was virtually non-existent yesterday, and trading from an activity and volume standpoint was very quiet. General digestion remains the best way to describe yesterday’s price action.

Did you enjoy the stock market update excerpt?

To start 2017, I am continuing to extend a special offer to new subscribers of our full, daily report that we call our “2 week grace period.”

If you subscribe to The Sevens Report today, and after the first two weeks you are not completely satisfied, we will refund your first quarterly payment, in full, no questions asked.