Will Chinese Credit Impulse Impact Global Markets? June 22, 2017

Yesterday’s article: Why Credit Impulse Matters.

If you feel like at any moment this market could turn around – and in a hurry—subscribe to The Sevens Report! Stay one step ahead of the markets.

One of the reasons I watch China so closely (along with other macro analysts) is because for the last decade, every time China has had an economic scare it’s caused global markets to drop, sometimes violently. The most recent examples were Aug/Sept ’15 and Jan/Feb ’16.

More specifically, those two bouts of recent volatility ended at the same time as China massively re-engaged its credit creation machine (think QE) to support its economy. If you look at the chart below, Chinese credit creation declined in ’13-’14 and was flat through ’15.

But when the Chinese economy started to stall in mid to late 2015, officials massively ramped up the credit creation machine again. Maybe it’s just coincidence, but the US stock market hasn’t had a correction since.

Now, China is once again trying to shrink its massive credit “bubble.” And, they’re removing liquidity from the system, as both charts show.

I realize this isn’t the prettiest chart, but the point I’m trying to make is this: This ramp up in stocks started in February 2016 at the exact same time as China re-engaged its massive credit creation machine (i.e. loans and QE). It could totally be a coincidence, as there has been real earnings growth in the US… but that would be a BIG coincidence.

The question for us is: “Will it cause another scare in global markets?”

It hasn’t so far, but that doesn’t mean it won’t.

So, while it might seem odd that I consistently bring up China even when it’s not in the news, this is the reason: Historically when China tries to shrink its credit bubble, bad things happen. And, as they say, history in markets doesn’t repeat… but it does rhyme. So, the focus in the daily Sevens Report will remain on the Chinese economy and credit stats for the next several months.

Help your clients outperform markets—everything in business is a trade-off between capital and returns. See how much you can increase your returns with The Sevens Report.

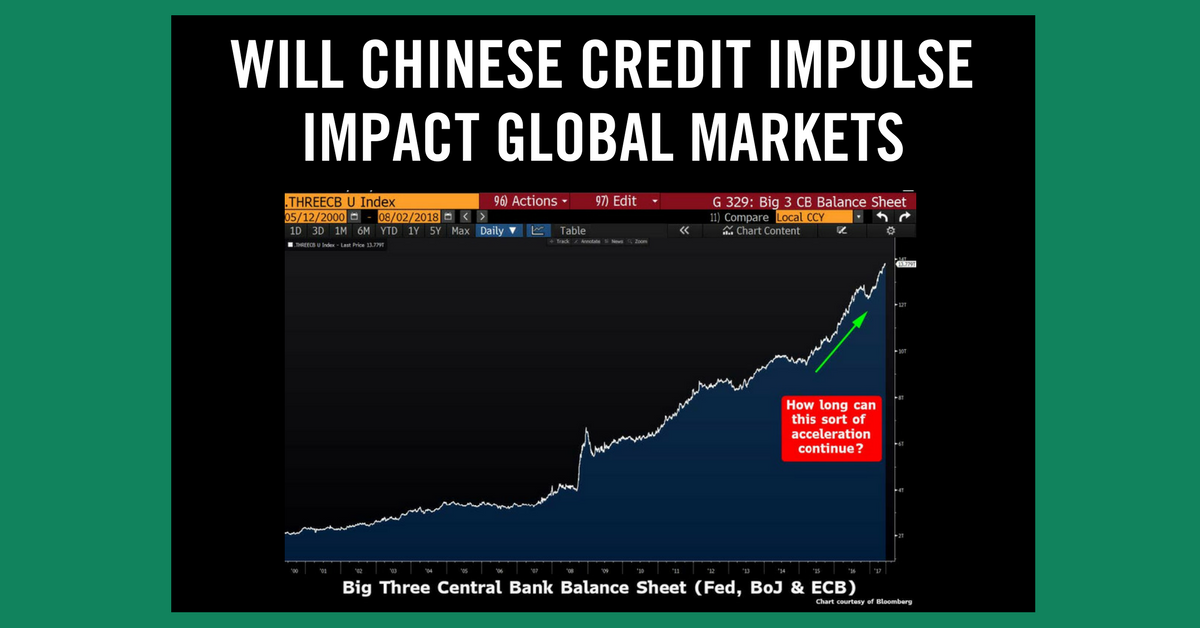

Credit Impulse Continued: This is a chart of the cumulative balance sheets of the ECB, BOJ and Fed. With increases of this magnitude, it’s understandable why stocks have rallied. Of course, that begs the question, “What happens when it starts to decline?”