Will the October Lows Hold?

What’s in Today’s Report:

- Subscriber Q&A: Will the October Lows Hold and What Is Going On Below the Market’s Surface?

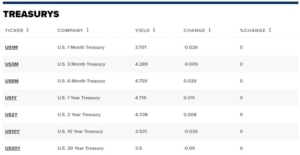

- The Gap Between the Fed and Markets is Closing

- Chart: 2-Yr Yield Approaches 2023 Highs

Stock futures are little changed while the dollar and Treasuries are steady following a quiet night of news as traders await Powell’s speech today.

Economically, German Industrial Production fell -3.1% vs. (E) -0.6% in December which is rekindling recession worries this morning and helping support the stabilization in bond markets.

Looking into today’s session focus will be on Powell’s speech at 12: 40 p.m. ET as traders brace for the Fed Chair to potentially push back on the market’s dovish reaction to last week’s FOMC decision, something that happened multiple times in 2022 sparking big waves of volatility across asset classes each time.

Expectations for Powell’s speech have already become more hawkish since the January jobs report, however, so he would need to be explicit and firm about raising rates beyond 5% and not cutting rates in 2023 to cause a meaningfully hawkish reaction.

Beyond Powell, there are two lesser followed economic reports to watch: International Trade in Goods Services (E: -$68.8B) and Consumer Credit (E: $25.0B) although neither should have a material impact on markets while the Fed’s Barr also speaks this afternoon (2:00 p.m. ET).

There is a 3-Yr Treasury Note auction at 1:00 p.m. ET and the outcome will offer some evidence of bond traders’ initial take on Powell’s comments. If the auction tails significantly, expect some hawkish follow-through money flows into the afternoon.

Finally, earnings season continues with a couple of notable reports after the close today: CMG ($8.88) and PRU ($2.57).