Tomorrow’s Jobs Report

Tomorrow’s jobs report: Tom Essaye Quoted in BNN Bloomberg

Stock Futures Slide as Bond Yields Keep Rising

“Tomorrow’s jobs report may be the most important one of the year,” according to Tom Essaye, a former Merrill Lynch trader.

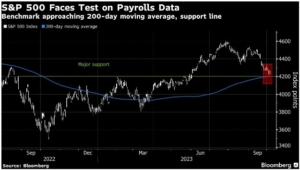

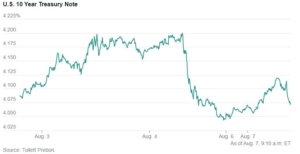

If the report is too hot and the yield on the U.S. 10-year bond moves close to 5 percent. “We could easily see the S&P 500 fall through the 200-day moving average and at that point we could see an acceleration of the declines in stocks,” Essaye wrote in his The Sevens Report newsletter.

Also, click here to view the full BNN Bloomberg article published on October 5th, 2023. However, to see the Sevens Report’s full comments on the current market environment sign up here.

To strengthen your market knowledge take a free trial of The Sevens Report.

Join hundreds of advisors from huge brokerage firms like Morgan Stanley, Merrill Lynch, Wells Fargo Advisors, Raymond James, and more! To start your quarterly subscription and see how The Sevens Report can help you grow your business, click here.