What’s in Today’s Report:

- Market Multiple Levels: S&P 500 Chart (Printable/Shareable PDF Available)

- NY Fed Inflation Expectations Data Takeaways

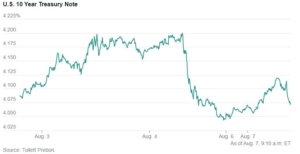

- Key Levels to Watch Today in the Dollar and Treasuries

Stock futures are modestly higher thanks to good economic data overnight as traders await today’s U.S. CPI report and more Fed speak.

Economically, the U.K.’s Unemployment Rate held steady below 4% but wage growth favorably slowed to 5.9% in January from 6.5% in December.

Meanwhile the NFIB Small Business Optimistic Index in the U.S. met estimates at 90.3 which saw S&P 500 futures hit new pre-market highs at the top of the 6:00 a.m. hour ET.

Today, focus will be on economic data early with CPI (E: 0.5% m/m, 6.2% y/y) and Core CPI (E: 0.3% m/m, 5.5% y/y) due out before the opening bell. Cooling inflation pressures have largely been priced in recently so a low print could see stocks add to YTD gains, but the risk is for a hot print to spark a significant wave of selling amid further hawkish shifting money flows across asset classes.

Moving through the day, there are three Fed speakers to watch: Logan (11:00 a.m. ET), Harker (1:00 p.m. ET), and Williams (2:05 p.m. ET) and they will all likely echo the hawkish tone coming from other Fed officials recently but their comments should not have a major impact on markets.

Earnings season is winding down but a few notable companies reporting today include: KO ($0.45), MAR ($1.84), ABNB ($0.27).