Why the Fed Wants Higher Rates

What’s in Today’s Report:

- Why Would the Fed Keep Hiking Rates if Inflation Is Coming Down?

- Jobless Claims Chart – Critical to See Further Move Higher

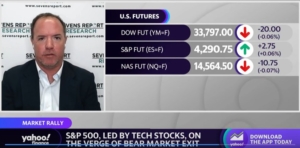

Equity futures are modestly higher this morning as traders weigh renewed optimism about Chinese growth against more hawkish policy speak from multiple ECB officials, including President Lagarde, reiterating the need for a “higher for longer” policy rate path.

Premier Li of China confirmed the government is committed to achieving their 5% GDP target overnight which helped Asian markets outperform and fueled modest risk-on money flows around the globe.

Today’s list of economic data releases is a long one with Durable Goods Orders (E: -1.0%), Case-Shiller Home Price Index (E: 0.5%), FHFA House Price Index (E: 0.4%), Consumer Confidence (E: 103.7), and New Home Sales (E: 663K).

Beyond those economic reports, there are no Fed officials scheduled to speak today but there is a 5-Yr Treasury Note Auction at 1:00 p.m. ET that could move yields and influence equity market trading.

Bottom line, in order for markets to stabilize here and stocks to resume their 2023 rally, we will need to see signs of slowing, but not collapsing growth in today’s economic data and no surprises in the Treasury auction. Looking ahead, trading may slow down some today as investors position into tomorrow’s Central Bank Forum hosted by the ECB in which Fed Chair Powell will participate.