What’s in Today’s Report:

- How to Explain Inflation to Clients and Prospects

- JOLTS Return to Pre-Covid Trend Path, But Is That Enough for the Fed?

- ISM Manufacturing Index Takeaways – Another “Goldilocks” Report

- The Yield Curve Will Return to Zero, How It Gets There is What Matters Most (Chart)

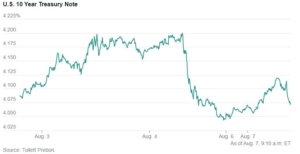

Stock futures are trading lower with global risk assets after a U.S. credit downgrade late yesterday.

Fitch Ratings downgraded the U.S. from its top rating AAA to AA+ yesterday, citing the massive fiscal deficit, but the downgrade should not result in any forced selling of Treasuries and therefore should have a limited near-term impact on yields and markets more broadly.

Looking into today’s session, focus will be on the U.S. credit downgrade as investors digest the potential implications on fixed income markets and re-assess valuations of risk assets, but we also get the first look at July jobs data in the form of the ADP Employment Report (E: 185K) ahead of the bell. If the data comes in “too hot” or “too cold” market volatility may pick up this morning. Motor Vehicle Sales will also be released (E: 15.6 million) but that data should not move markets.

There are no Fed speakers or notable Treasury auctions today, so beyond the early jobs data investors will continue to focus on Q2 earnings season with CVS ($2.12), KHC ($0.74), and PSX ($3.54) releasing results before the open while PYPL ($1.16), QCOM ($1.63) and MET ($1.85) will report after the close.

Sevens Report Technicals – Five Recessionary Bear Market Signals to Watch

The biggest risk to equity markets right now is a hard economic landing developing in H2’23 or sometime in 2024. Using modern market history as a guide, stock market rallies following yield curve inversions are typically reversed entirely during subsequent recessions (so all of the 2023 gains are at risk, and then some).

So, in this week’s edition of Sevens Report Technicals we included a list of Five Recessionary Bear Market Signals to Watch, which includes specific levels to monitor in various asset classes that will help us realize the onset of a looming recession in real time.

The feedback on Sevens Report Technicals has been overwhelmingly positive since its launch in May. One subscriber recently wrote in: “Having been in the business for 36 years and retired for 16, I truly believe this is the best report I have ever seen. The way you organize it and the info I glean from it helps my trading. I really look forward to each Monday’s report.”

To access this week’s edition of Sevens Report Technicals, please send an email to info@sevensreport.com to start a risk-free subscription. We offer a 30-day money back guarantee, so you risk nothing to see for yourself how Sevens Report Technicals can help you and your business.