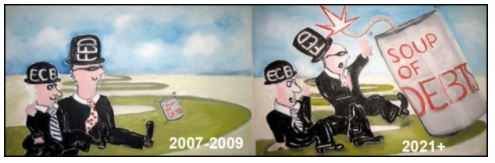

Are Policy Mistake Fears Rising?

What’s in Today’s Report:

- Bottom Line: Are Central Banks Tightening Policy into an Economic Slowdown?

- Philly Fed and Flash PMI Takeaways (Both Missed Expectations)

- Chart: Jobless Claims Remain Low

U.S. stock futures are trading lower along with most global equity markets today as investors digest the hawkish shift by most global central banks this week while concerns about the health of the economy rebound continue.

Economically, Eurozone HICP (their CPI equivalent) rose 0.4% vs. (E) 0.5% in November, easing some of the recent inflation concerns while the latest German Ifo Survey missed estimates on both current and future business expectations metrics which weighed on the regional growth outlook.

Today, there are no economic reports due out in the U.S. however there are two Fed speakers to watch: Daly (1:00 p.m. ET) and Waller (1:00 p.m. ET). The market will want to see Fed chatter echo Powell’s mostly dovish tone from the press conference on Wednesday and any hints at a more aggressive or sooner rate hiking cycle will cause more volatility today.

Finally, today is quadruple witching options expiration so expect very high trading volumes along with the threat of amplified moves as traders continue to digest this week’s hawkish pivot amid year-end rebalancing.