What’s in Today’s Report:

- 4 Questions for the Selloff: Why Have Stocks Dropped to the March Lows, What’s Holding Up Best, What Makes This Stop, and How Bad Can It Get?

S&P futures are up 1% this morning as yesterday’s steep declines are digested amid upbeat earnings and guidance out of MSFT after the close yesterday (MSFT is up 5%).

Economic data was net negative overnight as Australian CPI was hotter than expected while U.K. CBI Distributive Trades and the German GfK Consumer Climate Index both badly missed estimates, however, investors are shrugging off the data as the focus is on earnings this morning.

Looking into today’s session, there are two economic reports: International Trade in Goods (E: -$105.0B) and Pending Home Sales (E: -1.1%) but neither should move markets and no Fed officials are scheduled to speak.

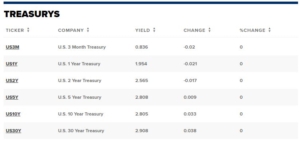

There is a 5-Yr Treasury Note auction at 1:00 p.m. ET that could move the bond market as yields have pulled back considerably since last week’s highs and a reversal back higher could become a headwind on stocks again, especially growth names.

Finally, the market’s main focus at the moment is earnings and we will get results from: BA (-$0.26) and HOG ($1.52) before the bell and then FB ($2.58), F ($0.39), PYPL ($0.89), QCOM ($2.91), and DFS ( $3.58) after the close. If earnings, especially by big tech companies can top estimates, a relief rally could play out as stocks are near-term oversold, however, momentum through yesterday’s close has been decidedly negative and the price action remains heavy.