Explaining My Market View More Clearly

Explaining My Market View More Clearly: Start a free trial of The Sevens Report.

What’s in Today’s Report:

- Explaining My Market View More Clearly – Subscriber Q&A

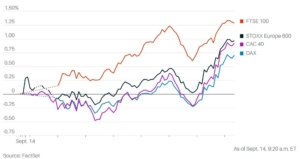

- Chart: Visualizing the Recent Market Rotation

Futures are flat while overseas markets were mixed overnight with European shares trading higher on tech earnings optimism but Chinese markets fell on growth concerns.

There were no market moving economic reports overnight.

Looking into the U.S. session, there are no Fed officials scheduled to speak today and just one economic release to watch this morning: Existing Home Sales (E: 3.99M).

Additionally, there is a 2-Yr Treasury Note auction at 1:00 p.m. ET that could be a catalyst for bonds and ultimately impact stocks (especially if the outcome is weak, it could weigh on risk assets).

Finally, earnings season continues to pick up with UPS ($1.98), GM ($2.64), and KO ($0.80) releasing results before the bell and TSLA ($0.59), GOOGL ($1.84), V ($2.41), and COF ($3.28) reporting after the close.

Join thousands of advisors from huge brokerage firms like Morgan Stanley, Merrill Lynch, Wells Fargo Advisors, Raymond James, and more! To start your quarterly subscription and see how The Sevens Report can help you grow your business, click here.