What to Make of Yesterday’s Drop & Jobs Report Preview

What’s in Today’s Report:

- What to Make of Yesterday’s Drop

- Jobs Report Preview

- Natural Gas Update

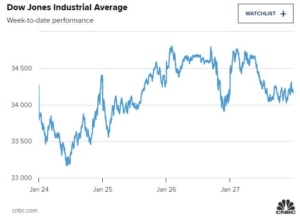

Futures are slightly lower as markets digest the whiplash of the past two trading days following a mostly quiet night.

German economic data again badly missed estimates as German Industrial Production fell –3.9% vs. (E) -1.0% and fears of outright stagflation in the EU are rising quickly.

Today focus will be on the Jobs Report and estimates are as follows: Job Adds: 400K, UE Rate: 3.6%, Wages: 0.4% m/m, 5.5% y/y. This market needs a “Goldilocks” report that’s subdued on wages and with job adds modestly below the estimate of 400k. If markets get that Goldilocks jobs report it should help stocks stabilize. If the report ends up “Too Hot” though, especially on wages, brace for more selling.

There are also numerous Fed speakers today including: Williams (9:15 a.m. ET), Kashkari (11:00 a.m. ET), Bostic (3:20 p.m. ET), Waller and Bullard (7:15 p.m. ET) and Daly (8:00 p.m. ET). Don’t be surprised if they all sound more hawkish than Powell did on Wednesday. Remember, it appears the Fed’s tactic is to “Talk Tough” on looming rate hikes and inflation, yet be more measured on actual rate hikes than rhetoric would suggest. Regardless, if there’s a consistent chorus of hawkish commentary, that will likely weigh on stocks, at least partially.