What’s in Today’s Report:

- Trade Update – What’s the Latest?

- Key Levels to Watch in the Dollar and 10 Year Yield

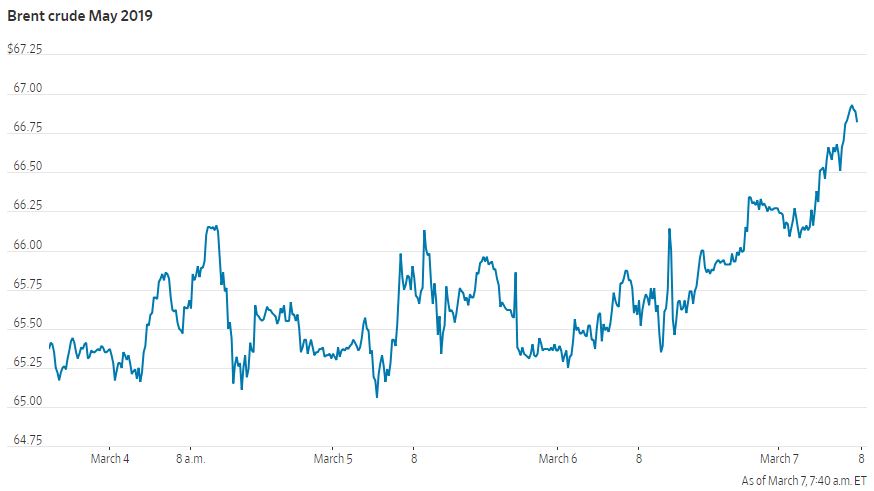

- OPEC Update – Positive or Negative for Oil?

Futures are modestly higher again as markets ignore more soft economic data and instead focus on incrementally positive U.S./China trade headlines.

China reduced import tariffs on U.S. soybeans and pork and that’s being interpreted as a mild positive in the negotiations, and that’s the reason futures are higher.

Economic data again disappointed as Japanese Household Spending and German IP (-1.7% vs. (E) 0.2%) both missed.

Today the key event on the calendar is the jobs report, (E: Jobs: 180K, UE Rate: 3.6%, Wages: 0.3%) and again the stronger the number, the better. We also get Consumer Sentiment (E: 96.8) this morning, and given the focus on consumer spending, that number is more important than usual. Like the jobs report, the stronger the number, the better for stocks.

Finally, regarding trade, Larry Kudlow will speak on CNBC at 9:30 so we’ll likely get another non-specific, yet positive, update on the U.S./China trade “mood music,” so don’t be surprised if you see a temporary pop in stocks right at the open.