The Sevens Report is everything you need to know about the market, in your inbox by 7am each morning in seven minutes or less. Sign up for your free, no obligation, two-week trial today.

In Monday’s Sevens Report, we talked about how momentum, more so than anything else, is driving this rally in stocks. And while momentum is clearly a powerful force, it can also be fickle. When momentum dissipates, there are usually air pockets underneath the market (see August 2015).

The trick to outperforming, then, is knowing when momentum is waning, and we want to identify three momentum indicators we’re watching to stay ahead of that move. Those momentum indicators are: Two tech sub-sectors (FDN and SOXX), the NYSE Advance/ Decline Line, and Market Sentiment.

Momentum Indicator #1: Sentiment Indicators.

Starting with the latter, it’s important to realize that momentum and sentiment, while related, are different. Momentum refers to a state of market psychology where higher prices themselves become the biggest bullish force, as underinvested people and portfolio managers chase stocks higher and aggressively buy any dip out of fear of underperforming. Unlike sentiment, strong momentum is not, by itself, a contrarian indicator (like overly bullish or bearish sentiment indicators).

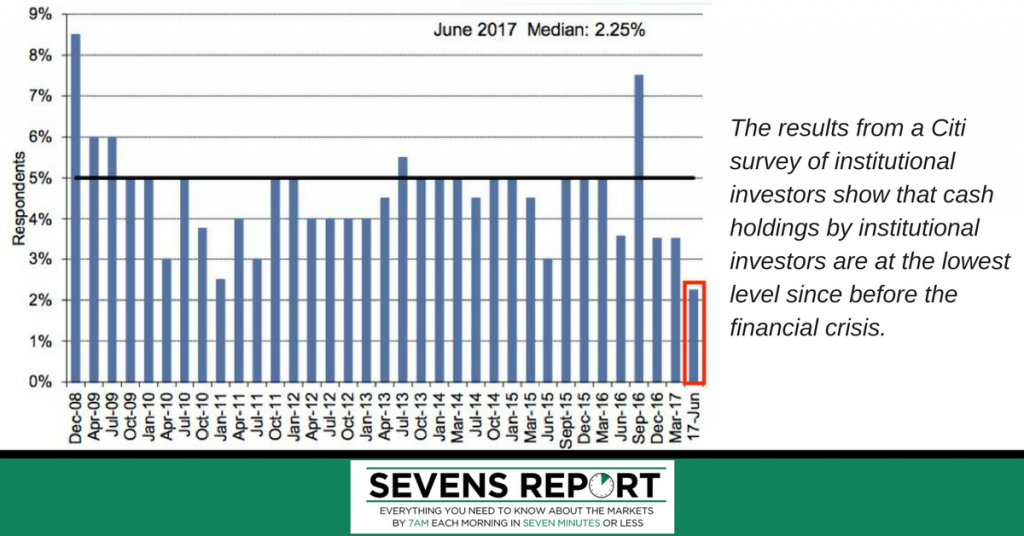

That said, in today’s market, a very bullish sentiment indicator could be a sign of an impending loss of momentum, as the bullish reading implies that everyone is “all in” on stocks, leaving a lack of capital on the sidelines that can “chase” stocks higher.

Right now, despite new highs in stocks, there are few signs that sentiment is near the highs. In fact, sentiment remains remarkably depressed for how strong the market has been in 2017.

The AAII Investors Sentiment Survey showed just 26.9% bulls vs. the historical average of 38.5%. The TMI Group Market Sentiment Index revealed just 49.8% bulls (the scale goes to 100) while the Citi Panic/Euphoria Model remains comfortably in “Neutral” range.

Point being, if bullish sentiment is a sign of an impending loss of momentum in stocks, we’ve got a long way to go.

Momentum Indicator #2: FDN & SOXX.

One of the reasons I look at sector trading every single day is because every rally is driven by a few sectors, or what I and others call “leadership” sectors. When these leadership sectors falter, that usually implies an impending loss of momentum.

Since late 2016, semiconductors have been the biggest leadership sector in the markets. They rallied big during the Q4 ’16 rally, and they are up big so far in 2017 (SOXX up 22%). While other sector leadership shifted from late ’16 to ’17 (banks and small caps to utilities, consumer staples and super-cap internet) semiconductors have continued to scream higher.

Similarly, as I and others have noted, nearly half of the 2017 S&P 500 rally can be attributed to just a few stocks: AAPL, AMZN, MSFT, FB, GOOGL. Those stocks are heavily weighted in the super-cap internet ETF FDN, and as such, that is also a leadership sector in 2017.

So, these are two important sectors to watch as any possible breakdown will imply a loss of momentum. It happened in the spring of ’14 when the then leadership sector biotech broke down and caused a pullback. It also happened before the pullback in August ’15 when the “FANG” stocks (leaders at the time) topped out in July— a month before the stock market fell.

Right now, the uptrends in FDN and SOXX are in good shape, but we will be looking for a violation of those uptrends as a clue the market may be about to lose momentum.

Momentum Indicator #3: NYSE Advance/Decline Line.

I’m not a huge fan of multiple measures of market breadth, but I do watch the advance/decline line, as it gives insight into buyer enthusiasm (i.e. the level of momentum). And, it has been an accurate leading indicator in these types of markets (the A/D Line topped out in April 2015, a month before the market topped in May).

Right now, the A/D line just hit a new high. But, once again, we’re looking for any signs of a trend break as a sign that momentum is waning.

Bottom Line

You’ll never hear me say that fundamentals don’t matter, because they do over the medium/longer term, and that’s what most of us are focused on. Yet we’re also judged in the short term by our clients and our competition, so getting both right is important.

Momentum in stocks remains higher still, but getting the break right, before our competition, will be the key to outperforming. With stocks this extended, a sharp, nasty and painful pullback is lurking somewhere out there. We’re focused on making sure you avoid it, and we’ll update you when any of these momentum indicators begin to break down.

Skip the jargon, arcane details and drab statistics from in-house research, and get the simple analysis that will improve your performance with the Sevens Report. Start your free trial today.

I don’t have a crystal ball, so I don’t know when normal volatility will return. However, I do want to spend a few moments pushing back on the idea that low volatility by itself means a correction is coming (obviously volatility will return, but as usual the key question is “when,” and ultra-low volatility doesn’t always mean it’ll return to normal levels soon).

I don’t have a crystal ball, so I don’t know when normal volatility will return. However, I do want to spend a few moments pushing back on the idea that low volatility by itself means a correction is coming (obviously volatility will return, but as usual the key question is “when,” and ultra-low volatility doesn’t always mean it’ll return to normal levels soon).