Tom Essaye Quoted in Crain’s Cleveland Business on August 6, 2021

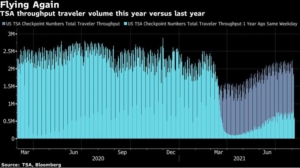

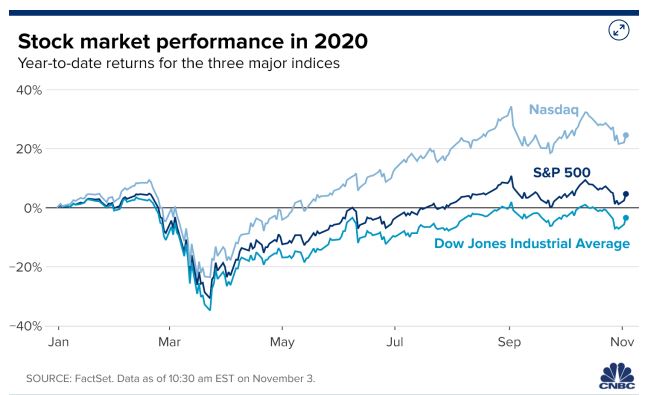

Wall Street is watching where you’re going to make some big bets

Rising COVID cases will only hurt the market if they result in a change in…Tom Essaye, a former Merrill Lynch trader who writes the “Sevens Report” newsletter, wrote in a note. Click here to read the full article.