The Sevens Report is the daily market cheat sheet our subscribers use to keep up on markets, seize opportunities, avoid risks and get more assets. Sign up now for a risk-free two-week trial, and see how it feels to be in the know. www.7sReport.com

The simple answer is probably not, but there is a better chance than previous meetings because of one simple reason: Despite two rate hikes since December, in aggregate, “financial conditions” have gotten “looser” in 2017, so Fed rate hikes aren’t really working.

Financial conditions is a term that was coined (for all intents and purposes) after the financial crisis, so we could see financial conditions were getting very tight (i.e. less credit availability) and when liquidity was drying up.

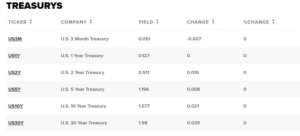

Now, in a post-crisis world, multiple institutions keep “Financial Conditions Indices” that measure the level of interest rates, liquidity in the system, credit availability and other measures of whether the availability of money and credit is getting loose (i.e. more availability) or tight (less availability).

I watch three such indices: (withheld for subscribers—unlock with a free trial). All three have slightly different methodologies, but all generally try and accomplish the same objective, which is to see if financial conditions in the economy are “looser” (i.e. easier credit/more liquidity) or if they’re getting “tighter” (i.e. less credit and less liquidity).

Here’s the important takeaway: All three financial conditions indices have shown aggregate financial conditions getting looser since the start of the year. In fact, in aggregate, financial conditions have eased by the equivalent of a 25 basis point rate cut since 2017 started, despite two rate hikes.

The reasons for this are somewhat obvious: Liquidity remains ample; credit remains readily available, interest rates are down, the stock market and housing prices are up (so more ability to borrow).

From a Fed standpoint, the takeaway is this: The fact that the Fed’s “slow walk” in interest rates isn’t mopping up excess liquidity in the market may make the central bank more prone to get “hawkish,” which again would be positive for banks and cyclicals (i.e. the reflation trade), but negative for defensives and higher-yielding sectors (utilities, consumer staples, REITs).

Again, I’m not saying the Fed will be surprisingly hawkish today, but if I had to bet on a surprise based on these financial conditions indices, I’d bet hawkish over dovish (although I’m making the dangerous assumption the Fed is serious about getting rates back to normal levels).

Bigger picture, though, the takeaway here is that the Fed’s policies, so far, are not having the desired effect. And, if this continues, the Fed will have to “shock” markets with a substantial rate hike at some point if it wants to regain market related credibility—and that increases the risk of higher rates over the longer term (or, higher inflation if they don’t provide that shock).

Join hundreds of advisors from huge brokerage firms like Morgan Stanley, Merrill Lynch, Wells Fargo Advisors, Raymond James and more… see if The Sevens Report is right for you with a free two-week trial.