Goldilocks Jobs Report Preview: What Will Make the Report too Hot, too Cold, or Just Right?

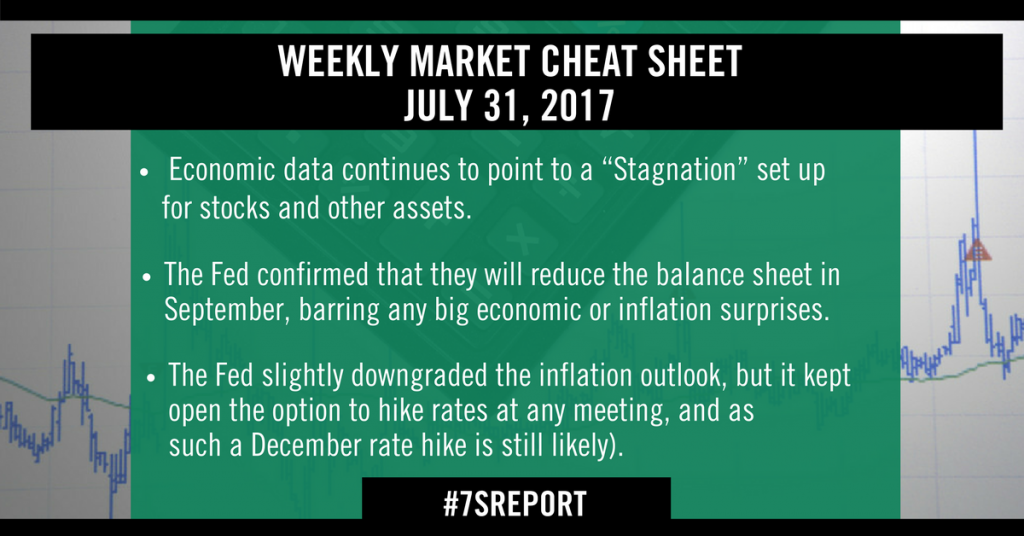

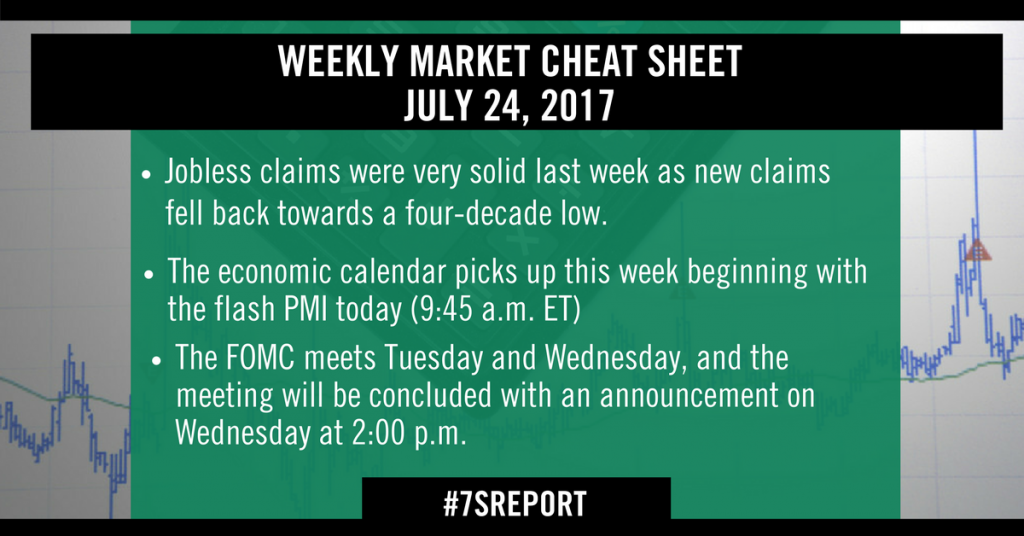

Given the Fed’s newfound confidence in inflation and economic growth, the bigger risk for stocks will be if tomorrow’s number comes in “Too Cold,” and further implies the economy is losing momentum into a hiking cycle.

However, while a “Too Cold” scenario would likely be the worst outcome for stocks, “Too Hot” wouldn’t be ideal, either, as it would cause a resumption of the reflation trade we saw in June.

So, there are two-sided risks into tomorrow’s jobs report, and if it’s outside of the “Just Right” scenario, we will either see some important sector rotation, or a broader market movement.

“Too Hot” Scenario (Potential for Two More Rate Hikes in 2017)

• >250k Job Adds, < 4.1% Unemployment, > 2.9% YOY wage increase. A number this hot will open the discussion for another rate hike, likely in September or November.

Likely Market Reaction: We should see a powerful reengagement of the “reflation trade” from June… (withheld for subscribers only—unlock specifics and ETFs by signing up for a free two-week trial).

“Just Right” Scenario (Confirms expectations of September balance sheet reduction & December rate hike)

• 125k–250k Job Adds, > 4.1% Unemployment Rate, 2.5%-2.8% YOY wage increase. This is the best-case scenario for stocks, as it would reinforce the current expectation of balance sheet reduction in September, and one more 25-bps rate hike in December.

Likely Market Reaction: This is the most positive outcome for stocks… (withheld for subscribers only—unlock specifics and ETFs by signing up for a free two-week trial).

“Too Cold” Scenario (Economic Growth Potentially Stalling)

• < 125k Job Adds. The key to a sustained, longer term breakout in stocks is stronger economic growth that leads to higher interest rates, and a soft number here would further undermine that outcome, and imply the Fed is hiking rates into an economy that is losing momentum.

Likely Market Reaction: (Withheld for subscribers only—unlock specifics and ETFs by signing up for a free two-week trial).

Again, given the Fed and other central banks newfound hawkishness, this is the worst outcome for stocks over the coming weeks and months.

Bottom Line

This jobs report isn’t important because it will materially alter the Fed’s near-term outlook. Instead, it’s important because if it prints “Too Cold” it could send bonds and bank stocks through their 2017 lows. And while I respect the fact that stocks have been able to withstand that underperformance so far in 2017, I don’t think the broad market can withstand new lows in yields and banks.

Cut through the noise and understand what’s truly driving markets, as this new political and economic reality evolves. The Sevens Report is the daily market cheat sheet our subscribers use to keep up on markets, seize opportunities, avoid risks and get more assets. Sign up for your free two-week trial today and see the difference 7 minutes can make.