Headline and Core CPI – The Important Difference

Difference Between Headline and Core CPI: Strengthen your market knowledge with a free trial of The Sevens Report.

What’s in Today’s Report:

- The Important Difference Between Headline and Core CPI

- NFIB Small Business Optimism Index Contradicts the “No-Landing” Scenario

U.S. stock futures are tracking global shares lower this morning following more disappointing economic data in the Eurozone and continued pressure on the tech sector.

AAPL shares are extending yesterday’s post-product launch declines this morning, therefore, weighing on the tech sector broadly in pre-market trading.

Economically, U.K. GDP dropped to -0.5% vs. (E) -0.2% in July after hot wage data yesterday, bolstering stagflation fears while EU Industrial Production fell -1.1% vs. (E) -0.7%. Despite the recently soft data, rates markets continue to price in a 75% chance of an ECB rate hike this week.

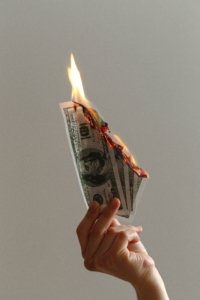

Today, focus will primarily be on inflation data and how Treasuries react to the release: CPI (0.6% m/m, 3.6% y/y), Core CPI (E: 0.2% m/m, 4.4% y/y).

There are no Fed speakers or Treasury auctions today so a “hot” CPI report will likely spark cross-asset volatility while a Goldilocks release will setup a possible extension of the early September relief rally.

Join hundreds of advisors from huge brokerage firms like Morgan Stanley, Merrill Lynch, Wells Fargo Advisors, Raymond James, and more… To start your quarterly subscription and see how The Sevens Report can help you grow your business, click here.