Are We Seeing “Green Shoots” of A Global Reflation?

• Chinese August CPI rose 1.8% yoy vs. (E) 1.7% yoy.

• British Core CPI rose 2.7% vs. (E) 2.5% yoy.

Takeaway

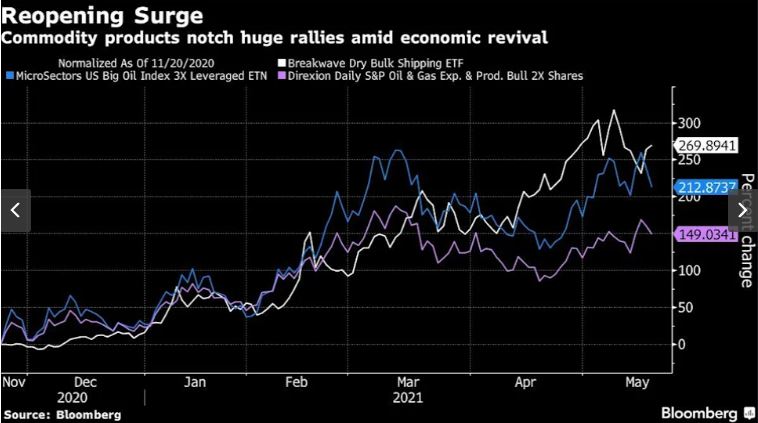

Are there “green shoots” of inflation? I reference the Bernanke comments regarding economic growth here, because very quietly we’ve seen two better-than-expected inflation numbers in two big economies (technically three if you count the uptick in Indian CPI, although that’s not widely followed).

August Chinese CPI beat (it came out Friday but couldn’t be priced in until markets opened on Monday) but it was the big uptick in core British CPI that saw the market extend the rally on Tuesday.

So, the logical question, given these two surprise beats is, “Will US CPI also surprise markets?”

The inclination is to believe in the trend, but to be clear, higher Chinese and British CPIs have no real bearing on US CPI—so strong numbers in those two reports don’t increase the likelihood of a strong CPI number.

But, if it comes, expect some potentially big market moves across Treasury yields, the dollar, and in stock

sector trading (banks and cyclicals will scream higher while defensives, including parts of tech, will likely badly lag). But again, that will depend on tomorrow’s number.

From a market standpoint, looking at the effects of the strong Chinese and British CPI, the clear ETF winner is…(withheld for subscribers only—unlock specifics and ETFs by signing up for a free two-week trial).

I continue to believe that an economic reflation (better growth, higher inflation) remains the key to a sustained US and global stock rally. And while two numbers don’t make a trend, they were the first positive surprises we’ve had on inflation in months, and we think that’s potentially very important (if it continues).

Cut through the noise and understand what’s truly driving markets, as this new political and economic reality evolves. The Sevens Report is the daily market cheat sheet our subscribers use to keep up on markets, seize opportunities, avoid risks and get more assets. Sign up for your free two-week trial today and see the difference 7 minutes can make.