What Greenland Headlines Mean for Markets

What’s in Today’s Report:

- What the Greenland Headlines Mean for Markets

- Weekly Economic Outlook – Core PCE in Focus

Global markets are “risk-off” thanks to geopolitical tensions between the U.S. and Europe surrounding Greenland and a sharp rise in bond yields due to Japanese fiscal worries.

Economically, Germany’s ZEW Survey topped estimates with Economic Sentiment firming to 59.6 vs. (E) 50.0 but the data is being overshadowed by the sharp rise in JGB yields and geopolitical turmoil.

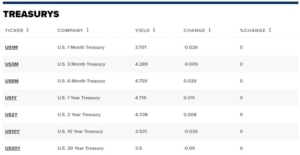

There are no economic reports today, however, the Treasury will hold auctions for 3-Month and 6-Month Bills at 11:30 a.m.

ET and 6-Week and 52-Week Bills at 1:00 p.m. ET. Strong demand (dovish) should help stocks stabilize as we start the week.

There are no Fed officials scheduled to speak today which will leave traders watching earnings closely with FITB ($1.01), MMM ($1.82), DHI ($1.96), USB ($1.19), NFLX ($0.55), IBKR ($0.51), and UAL ($2.98) all reporting Q4 results today.