The Most Important Long-Term Market Indicator

The Most Important Long-Term Market Indicator: Start a free trial of The Sevens Report.

What’s in Today’s Report:

- The Most Important Long-Term Indicator for Markets

- Remaining Catalysts This Week

- Chart: 2-Yr Yield Quietly Breaks Out to New 2024 Highs

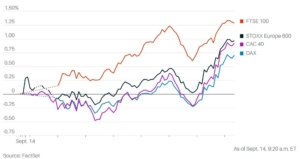

S&P futures are flat while Treasury yields are slightly lower and the dollar is little changed following a quiet night of news ahead of today’s critical U.S. CPI report.

In corporate news, TSM reported the fastest revenue growth since 2022, renewing some AI optimism in global markets.

The biggest catalyst of the day will hit before the bell with CPI (E: 0.3% m/m, 3.5% y/y) and Core CPI (E: 0.3% m/m, 3.7% y/y) being reported at 8:30 a.m. ET. Simply put, a “hot” print will be hawkish and bad for stocks; a “cool” print will be “risk-on.”

There are no other economic reports on the calendar, however, there is a 10-Yr Treasury Note auction at 1:00 p.m. ET and the monthly Treasury Statement (-$340B) will hit the wires at 2:00 p.m. ET. Both could move yields and impact stocks (higher yields will pressure equities).

Regarding the Fed, there are two speakers on the schedule today, Bowman right after CPI (8:45 a.m. ET), and Goolsbee mid-day (12:45 p.m. ET) before the March FOMC Meeting Minutes are released mid-afternoon (2:00 p.m. ET).

Any hawkishness in the speakers’ tone or language that points to “higher for longer” policy will be negative for stocks. Conversely, if a summer cut and three total 2024 rate cuts are reinforced that will support risk assets and rally stocks broadly.

Join thousands of advisors from huge brokerage firms like Morgan Stanley, Merrill Lynch, Wells Fargo Advisors, Raymond James, and more! To start your quarterly subscription and see how The Sevens Report can help you grow your business, click here.