What the CPI Report Means for Markets

What’s in Today’s Report:

- What the CPI Report Means for Markets

- EIA and Oil Market Analysis

It’s “green on the screen” as global indices and U.S. futures extend yesterday’s CPI driven rally.

Economically, UK Industrial Production (IP) was better than feared (down –1.2% vs. (E) -1.5%) while EU IP slightly missed estimates (0.2% vs. (E) 0.5%).

Earnings season officially begins today and the first reports are solid, as PEP and DAL both beat earnings estimates.

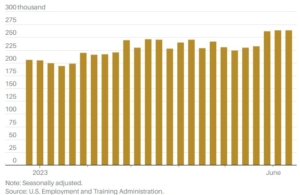

Today focus will be on economic data, specifically Jobless Claims (E: 245K) and PPI (E: 0.2% m/m, 0.4% y/y, Core PPI E: 0.2% m/m, 2.8% y/y). If jobless claims are mostly stable and PPI falls more than expected, markets should extend yesterday’s “Immaculate Disinflation” driven rally. Finally, there is one Fed speaker today, Waller (6:45 p.m. ET), but markets are ignoring hawkish rhetoric right now so he shouldn’t move markets.