Market Multiple Chart

What’s in Today’s Report:

- Market Multiple Chart

- Why the Rally Has Stalled This Week (Three Reasons)

Futures are moderately lower thanks to more regulatory fears in China and earnings guidance cuts from U.S. companies.

China has warned tech companies about online gaming activities in the latest volley of potential regulations.

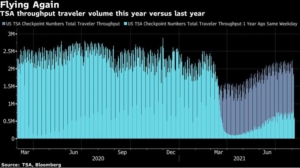

United Airlines (UAL) cut guidance as demand for air travel has softened recently due to rising COVID cases, adding to a surprisingly high number of guidance cuts this week.

Today the key event is the ECB Rate Decision (Press Release 7:45 a.m., Press Conference 8:30 a.m.) and markets will be looking to see if the ECB formally announces tapering is coming (it’s possible but not the consensus expectation). Away from the ECB, we also get Jobless Claims (E: 344K) and numerous Fed speakers today (nine speeches in total) but only Williams (2:00 p.m.) is leadership and we already know what he thinks from his comments yesterday (tapering will start in late 2020 but be gradual).