Commodities Update, August 22, 2017

The Sevens Report is everything you need to know about the markets in your inbox by 7am, in 7 minutes or less. Start your free two-week trial today and see what a difference the Sevens Report can make.

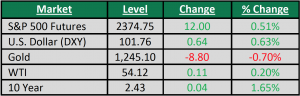

Commodities were mostly higher yesterday as gold continued to benefit from risk-off money flows and a weaker dollar, which also propped up copper futures. Meanwhile, crude oil bucked the trend and gave back most of Friday’s rally. The benchmark commodity index ETF, DBC, fell 1.21% thanks to he declines in energy futures.

Yesterday’s pullback in oil was a textbook retracement of Friday’s very “squeezy” rally. Shorts that were run out of the market late last week repositioned yesterday morning, which influenced the heavy trading that was largely dictated by technicals. WTI futures fell 2.22% on the day.

Friday’s big rally essentially created a “gap” in the market as the bulk of the move occurred in less than an hour, and on very light volume. That set things up for a reversal, and because newswires were very quiet yesterday, algos and technical traders took control of the market and largely “filled the gap” as we ended the day near where Friday’s rally began.

As far as the longer-term trend in oil goes, yesterday’s session was rather insignificant. The market remains in a broad, sideways range with the $50 mark continuing to act as a stubborn resistance level.

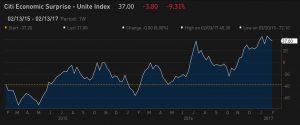

Fundamentally, the OPEC/NOPEC meeting in Vienna was anticlimactic. The previous extraordinary meeting was a non-event as well, and the market is beginning to shrug off OPEC-related headlines more and more as the cartel has been largely ineffective in recent months.

The oil market remain bearish for now, as US production continues to grind higher and OPEC has so far failed at trying to offer material support to the market through their policy decisions. Looking ahead, the $50 mark in WTI is a very important technical and psychological resistance level that will not likely be violated in the absence of a legitimate bullish catalyst.

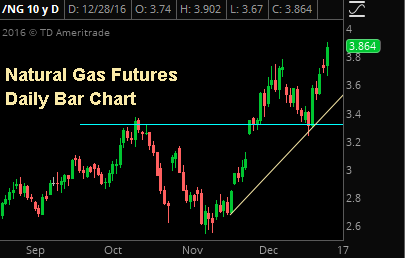

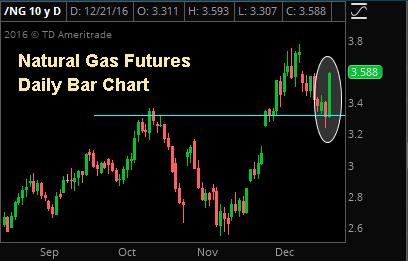

Natural gas rallied 2.42% yesterday as the market continues to show signs of life in the late summer. There was no real catalyst for the move yesterday, but nat gas is continuing to show signs of putting a bottom in and forming support in

the $2.80-$2.90 area.

Looking ahead, the bulls have their sights set on reclaiming the $3.00 mark, and a close above would be a bullish development on the charts. That would match the supply side fundamentals showing a potential long-term shift of supply levels turning lower.

In the metals, the weaker dollar was the primary influence on the market yesterday, as gold rallied 0.39% and copper rallied 1.36%. Gold continued to catch a bid from the cautious feel in the market after last week’s sharp pullback in stocks, but futures failed to close at a new high and above the $1300 mark despite rallying through the important resistance level briefly in Friday trade.

For now, we remain cautious on gold as the technical outlook is rather cloudy. If, however, bond yields break- down further (more on that in the currencies and bonds section) then gold will surely have the support to break out through $1300 and begin a new uptrend.

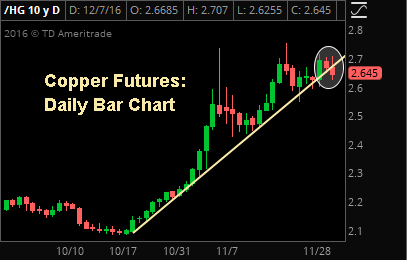

Copper continued to grind higher yesterday with futures hitting the highest level since late 2014. With the price action in gold and the bond market both flashing a warning sign for risk assets, copper continues to flash a positive signal for the global economy.

Looking ahead, the path of least resistance is still higher for copper, which is a positive for the global economic outlook and risk assets. Yet, the biggest thing to watch with regard to the rally is the dollar, as a reversal back higher in the buck could significantly damage the uptrend in all metals.

Time is money. Spend more time making money and less time researching markets every day. Subscribe to the 7sReport.com.

Why the Monthly OPEC Report Was Bearish Oil

Why the Monthly OPEC Report Was Bearish Oil