The Case for Emerging Markets, an excerpt from today’s Sevens Report. Everything you need to know about the market in your inbox by 7am, in 7 minutes or less.

As expectations for a pro-growth policy based reflation trade (i.e. the Trump trade) fade here in the US, one potential beneficiary is emerging markets. The sector has underperformed since the election due to a combination of

As expectations for a pro-growth policy based reflation trade (i.e. the Trump trade) fade here in the US, one potential beneficiary is emerging markets. The sector has underperformed since the election due to a combination of

1) Dollar strength,

2) Rising US bond yields, and

3) Fear of trade wars.

But, if we see an extended pause in the dollar and bond yield rally, and continued poor execution on pro-growth policies, then emerging markets offer value in an otherwise expensive market.

Now, I’m not saying I’m a long-term bull on emerging markets, nor does this analysis mean I’m not a long-term bull on the dollar or bond yields… I think both go higher long term.

However, the fact is this market has already priced in a an acceleration of growth in the US. If that doesn’t materialize, we could see a sideways chop in the dollar and bond yields, and emerging markets will likely outperform near term (i.e. the next few months).

The investment thesis behind EM is comprised of three pillars: Valuation, inverse correlation to the US-based reflation trade, and positive exposure to global growth.

Pillar 1: Attractive Relative Valuation. Emerging markets are much cheaper than most developed markets, as several research pieces we’ve read have emerging markets trading 12X forward P/E, compared to 17X and 15X for the US and Europe, respectively. So, there is value there, especially after the under-performance following the election.

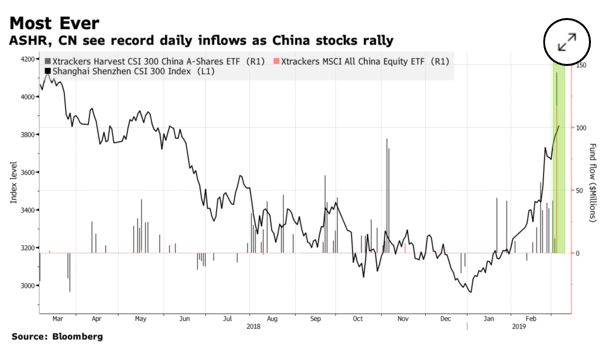

Pillar 2: Hedge Against a Reflation Trade Unwind. If we see the reflation trade continue to unwind (which started in earnest last Tuesday) then emerging markets will benefit. Case in point, since the election, our preferred emerging market ETF (withheld for subscribers) has returned 5.9%. But, almost all of those gains have come over the past few weeks thanks to the Fed’s dovish hike, and the healthcare failure.

If reflation trade enthusiasm wanes in the US, emerging markets will continue to benefit thanks to the weaker dollar and lower yields. To put it simply, emerging market returns are highly inversely correlated to the dollar. If we see the dollar continue to grind sideways or continue to fall, emerging markets should outperform.

Pillar 3: Positive Exposure to Global Growth. Finally, emerging markets should benefit from a rising global economic tide. US rate hikes aside, the rest of the world’s central banks remain very “easy,” and generally speaking global growth is on an upswing… and that should continue to benefit emerging markets. There are, however, risks to the trade. First, if we get border adjustments in a corporate tax cut package, that’s negative EM because it effectively puts a tax on all emerging market exports (i.e. raw materials), which will reduce demand. Second, if the Fed becomes more hawkish near term, then the dollar and bond yields will rise, and EM will lag. Third, if China sees another growth scare that will hurt EM. Finally, if the Trump administration begins to levy import taxes or engages in aggressive trade policies, that will obviously be EM negative. Of these risks, we view the most probable as the Fed getting more hawkish. But, near term that just isn’t very likely. So, the risks to this strategy are real, but we don’t view them as imminent.

Finally, I’m not saying emerging markets are a long-term strategy, but I do think EM is something that can outperform over the coming months, especially if we see a lack of progress on tax cuts. As such, EM offers reasonable upside in a market where not much is cheap, and we think the potential reward is worth the risk.

How to Play It

Reserved for subscribers of the Sevens Report. Sign up for your free 2-week trial to access our preferred ETF’s.

For a monthly cost of less than one client lunch, we firmly believe we offer the best value in the independent research space. Get your free trial of the Sevens Report today.

As expectations for a pro-growth policy based reflation trade (i.e. the Trump trade) fade here in the US, one potential beneficiary is emerging markets. The sector has underperformed since the election due to a combination of

As expectations for a pro-growth policy based reflation trade (i.e. the Trump trade) fade here in the US, one potential beneficiary is emerging markets. The sector has underperformed since the election due to a combination of