Sevens Report: 10-Year Yield Remains ‘Neutral’ for Stocks

Tom Essaye says the 4.20% range keeps markets stable — for now.

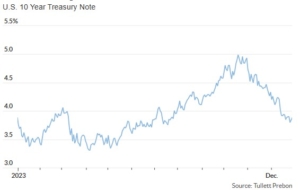

10-Treasury yield rises, but remains in range seen as ‘neutral’ for stocks

Treasury yields were rising Monday morning, with the rate on the 10-year note reversing its decline from last week but still trading in a range that Sevens Report Research called “neutral” for the stock market.

“The 10-year Treasury yield has been well behaved through this recent stock market volatility and in the 4.20% range it remains neutral for markets generally speaking,” Tom Essaye, founder and president of Sevens Report Research, wrote in a note Monday. “That needs to continue, because a sudden plunge below 4.00% would signal growth concerns, while a jump above 4.50% would imply rising inflation risks and both would add incremental headwinds on stocks (and possibly bonds).”

Also, click here to view the full article published in MarketWatch on February 9th, 2026. However, to see the Sevens Report’s full comments on the current market environment sign up here.

If you want research that comes with no long term commitment, yet provides independent, value added, plain English analysis of complex macro topics, then begin your Sevens Report subscription today by clicking here.

To strengthen your market knowledge take a free trial of The Sevens Report.

Join hundreds of advisors from huge brokerage firms like Morgan Stanley, Merrill Lynch, Wells Fargo Advisors, Raymond James, and more! To start your quarterly subscription and see how The Sevens Report can help you grow your business, click here.