What’s the TINA Trade?

/in Investing/by Tyler RicheyDo you know what the TINA trade is? I ask that, because I’m pretty sure talking about the TINA trade would have just gotten me new clients, if I was a financial advisor. I just finished giving a presentation on the economy and markets to a group of business executives. While most of the presentation […]

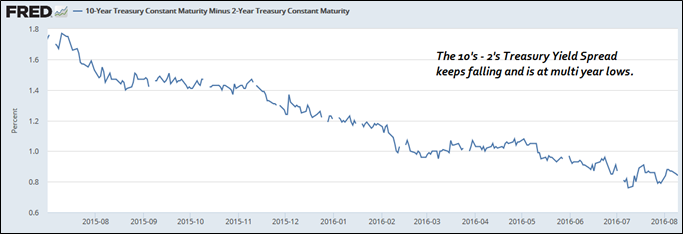

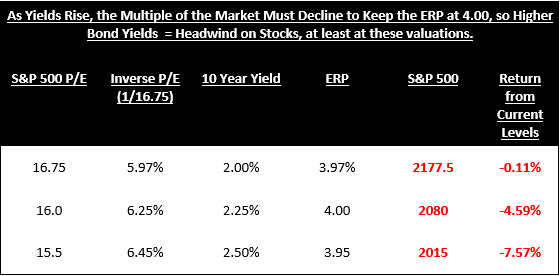

Could the Yield Curve Invert?

/in Investing/by Tyler RicheyYesterday, a subscriber called to tell me about a successful meeting he had with a client this week, in which the advisor explained: What the Equity Risk Premium was, Why it was driving stocks higher, and Why the 10-year yield is now a leading indicator for a potential correction in stocks. The client asked him […]

What is Earnings Per Share?

/in Investing/by Tyler Richey“It’s a good thing I’m retiring soon, because after almost 38 years in the business almost nothing makes sense in the markets anymore. So it’s a good thing I have you, who understands the way things work today.” That’s what Reed, an advisor and subscriber, wrote to me yesterday. If a guy with nearly four […]

Fed Roadmap

/in Investing/by Tyler RicheyWhen I think about what’s become of the Fed, it almost makes me sad. I’m dating myself a bit by saying this, but when I started in this business the Fed was a revered (and sometimes feared) institution. In the early 80s, “with a tear” in his eye, Volker rose interest rates and broke inflation. […]

Chart of the Day

/in Investing/by Tyler Richey“I’ve Got Your Six.” You may have heard that saying – it’s a military term and it means, “I’m watching your back,” as the “six” refers to your “Six O’clock.” Here at The Sevens Report, we often say that we’ve got our subscribers’ “six,” and that’s why in today’s paid edition of the Report we […]

The Real Reason Why Stocks Are Rallying

/in Investing/by Tyler RicheyThe music is back on. Several times over the past few years I’ve referred to the markets as a real life game of “musical chairs.” We all know the children’s game: When the music plays you run around the chairs and you hope that you have a place to sit when the music stops, otherwise […]

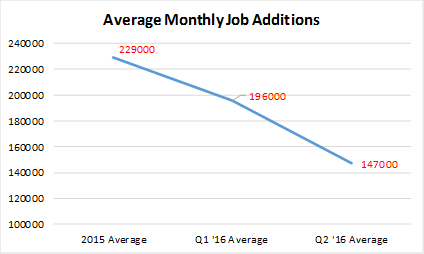

Jobs Day (Abbreviated Jobs Report Preview)

/in Investing, Reports/by Tom EssayeWhat’s in Today’s Report: Jobs Day (Abbreviated Jobs Report Preview).