The Real Reason Why Stocks Are Rallying

The music is back on.

Several times over the past few years I’ve referred to the markets as a real life game of “musical chairs.”

We all know the children’s game: When the music plays you run around the chairs and you hope that you have a place to sit when the music stops, otherwise you’re out.

It’s the same thing for central-bank-driven stock markets.

When the Fed is ultra-dovish, you have to “Run” (i.e. be in stocks) because stocks tend to go up regardless of economic fundamentals. But, you just have to hope that you have a seat when the music stops (i.e. the Fed actually gets serious about raising rates or the market finally realizes the Fed is out of bullets).

On Friday, following the jobs report, the “music” started again and investors piled back into stocks.

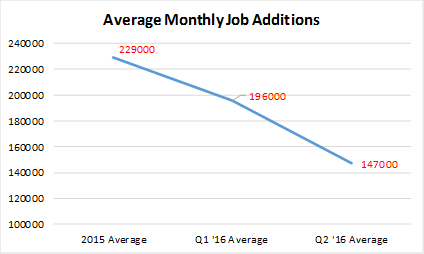

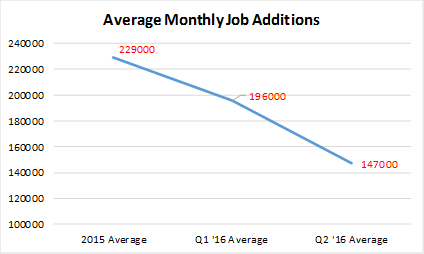

But, contrary to what you may have read in the financial media, Friday’s stock rally was not because of the strong jobs report. Yes, the headline was good, but the trend in job additions has been decidedly lower throughout 2016.

Instead, the reason for this huge rally in stocks is bonds – specifically that Treasuries went UP and yields went DOWN after the jobs report. Additionally, the Dollar was flat despite the strong jobs report.

That told investors that the market is now totally convinced that the Fed won’t raise rates this year, regardless of what happens in the economy, and as a result they piled into stocks.

So, it is the expectation of forever-low interest rates that is driving this stock rally – not any improvement in fundamentals.

Now, do we think this rally is heralding a new bull market in stocks?

No, we don’t.

The risks to this market are generally unchanged from three weeks ago, and we’re continuing to monitor those risks for our subscribers.

But clearly, the near-term trend is higher, and you learn quickly in this business you have to invest in the market you’ve got—and not the one you think you should have!

So, the question now is whether investors need to abandon those defensive equity positions and rotate into higher-growth/higher-beta sectors like tech/consumer discretionary and basic materials?

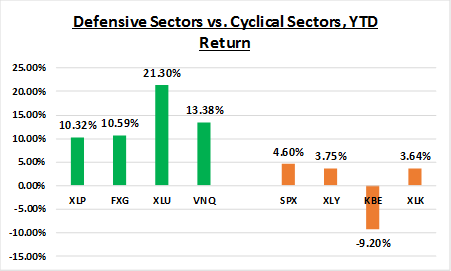

That’s a pretty important question from a performance standpoint, because defensive sectors have massively outperformed cyclical sectors in 2016 – and if we are going to see a massive rotation back in to cyclicals, then advisors need to know that to maintain outperformance.

We discussed the potential for that rotation in a recent edition of The 7:00’s Report and have included an excerpt for you below.

Are We Going to Witness a Great Rotation?

Most of the free excerpts you receive focus on macro topics, but in the paid edition of The 7:00’s Report

we include a general asset allocation model and list of tactical investment ideas we think can outperform over the medium term.

Throughout 2016, our general equity view has been “Cautious” where we advocate 2/3 allocation to defensive sectors (represented in the Report by SPLV) and 1/3 to higher-beta sectors (represented by SPHV).

Even with the S&P 500 hitting new highs, that allocation has handily outperformed the S&P 500 in 2016, as SPLV has risen 14% year to date, not including dividends, while SPHB has risen 1.4%, giving our “Cautious” allocation a weighed return of 9.6%, doubling the S&P 500’s 4.7% 2016 return.

But, right now, with stocks breaking out and people piling into equities, the question most advisors are asking is whether to rotate into more cyclical/higher-beta sectors.

That’s really important, because anyone who has been in defensive sectors has massively outperformed cyclical sectors year to date and knowing whether to stay in those sectors or rotate into cyclicals will be critical to outperforming for the remainder of 2016.

As we told subscribers earlier this week, we do not think this massive rotation is going to occur and currently we are advocating holding allocations to defensive sectors for anyone other than a short-term investor.

The reasoning behind that conclusion is fairly simple.

This rally is being driven by the idea that interest rates will stay low forever, regardless of the economy. And, as a result, that will continue to favor more income-oriented sectors (beyond the short term).

So, if the main justification for that breakout in stocks was that low interest rates have indeed made it “different this time” from a stock valuation standpoint, and because of record-low Treasury yields and the prospect of no rate hikes in the future, acceptable stock valuations are now higher than previous history.

So, if that is the reason that people are buying stocks, then it negates the “overvalued” argument towards defensive sectors (staples, utilities, REITs).

Yes, those sectors are overvalued compared to historical norms, but now so is the stock market, and if perma-low interest rates justify the valuation extension in the S&P 500, it must also justify the valuation extension in these defensive sectors.

And, so far, the price action has validated our thesis.

Despite the fact that consumer staples, utilities and REITs are basically at all-time highs, the relative underperformance since Friday is not nearly as big as it could have been given how “overbought” most people think utilities/staples and REITs currently are.

In fact, we were actually relatively impressed with the performance of consumer staples (XLP/FXG) on Friday, as given their recent outperformance we could have easily seen outright declines in both those sectors following that strong jobs report.

Getting this potential rotation “right” for subscribers will be very important, and it’s obviously going to be a fluid situation. So, to make sure we get this “right” for subscribers we are watching a single indicator to tell us whether this rotation is gaining steam.

Until we see a material break lower in the belly and long end of the Treasury curve, the income provided by staples, utilities, REITs and other defensive sectors will remain critical to outperforming in this market.

And, we will alert our subscribers to any break that occurs in Treasury yields and analyze the implications for the market in general and for equity asset allocations.

If you do not have one research document that provides macro analysis as well as tactical investment idea generation every day at 7 a.m., please consider a subscription to The Sevens Report.

We firmly believe we offer the best value in the paid research space.

I am continuing to extend a special offer to new subscribers of our full, daily report that we call our “2-week grace period.”

If you subscribe to The Sevens Report today, and after the first two weeks you are not completely satisfied, we will refund your first quarterly payment, in full, no questions asked.

Click this link to begin your quarterly subscription today.

Value Add Research That Can Help You Grow Your Business in 2016

Our subscribers have told us how our focus on medium term, tactical opportunities and risks has helped them outperform for clients and grow their books of business.

We continue to get strong feedback that our report is: Providing value, Helping our clients outperform markets, and Helping them build their business:

“Thanks for your continued insight; it has saved my clients over $2M USD this year… Keep up the great work!” – Top Producing FA from a National Brokerage Firm.

“Let me know if there is anything else that you need from us. Thanks again for everything. I really enjoy the Report – it is helping me grow my business and stay on top of things.” – Independent FA.

“Great service from a great company!!” – FA from a National Brokerage Firm.

“Great report. You’ve become invaluable to me, thanks for everything…! – FA from a Boutique Investment Management Firm.

Subscriptions start at just $65 per month, billed quarterly, and with the option to cancel any time prior to the beginning of the next quarter, there’s simply no reason why you shouldn’t subscribe to The 7:00’s Report right now.

Begin your subscription to The 7:00’s Report right now by clicking this link and being redirected to our secure order form.

Finally, everything in business is a trade-off between capital and returns.

So, if you commit to an annual subscription, you get one month free, a savings of $65 dollars. To sign up for an annual subscription, simply click here.

Best,

Tom

Tom Essaye,

Editor of The 7:00’s Report