Economic Cheat Sheet: February 13, 2017

/in Investing/by Tom EssayeLast Week: There was very little incremental economic data last week, and what reports did come met expectations and importantly did nothing to change the perception that economic activity is legitimately accelerating—a perception that continues to support stocks broadly. From a domestic data viewpoint, there isn’t a lot to talk about. Jobless claims continued to […]

Stocks Reach New Highs

/in Investing/by Tyler RicheyThe S&P 500 is now more than 6% above its 200 day simple moving average. And while the trend is clearly still bullish, the complacency in the market paired with the overextended conditions raise the chances of a pullback.

10 Year Note Yield Continues to Fall

/in Investing/by Tyler RicheyThe 10 Yr T-Note yield remains below the key 2.50% level and a considerable distance from the long term regression line which suggests a further correction is very plausible.

Bond Bubble

/in Investing/by Tyler RicheyA friend who runs a successful tax lien fund called me this past weekend with an interesting story. The portfolio manager of one of the biggest institutional investors, a $2-plus billion multi-family office on the West Coast, called him last week and told him to expect a bigger allocation soon because he (the PM of […]

Dollar Break-Out

/in Investing/by Tyler RicheyThe dollar index violated the 2017 downtrend yesterday which could mark the beginning of the next upswing for the greenback.

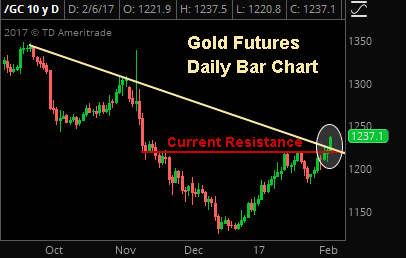

Gold Update

/in Investing/by Tyler RicheyGold futures violated a longstanding downtrend resistance line yesterday as well as established above the $1235 resistance area; two bullish technical developments.

Sentiment Update: Bullish Enthusiasm Reduced, But Not Eliminated

/in Investing, Reports/by Tom EssayeWhat’s in Today’s Report: Sentiment Update: Bullish Enthusiasm Reduced, But Not Eliminated