Tom Essaye Quoted in MarketWatch on January 10, 2019

/in Investing/by Customer ServiceTom Eassye was quote in MarketWatch on January 10, 2019. He warns clients in a Thursday note that the technicals don’t look good for stocks in the medium term, even as he sees the short-term path of least resistance going higher.

Earnings Season Preview (Market or Break for the Bull Market)

/in Investing/by Tom EssayeEarnings Season Preview: Two important factors, futures are slightly lower despite generally good news overnight, today is all about the CPI report (E: -0.1% m/m, 1.9% y/y). Both the headline and core need to stay around 2.0% yoy for this “dovish” Fed narrative to continue to grow, as a hot CPI report could undo some of the rally markets have enjoyed since last Friday and more.

Technical Update (Bounce or Bottom?)

/in Investing/by Tom EssayeTechnical Market Update – Bounce or Bottom?, U.S./China Trade Update (What’s Next and What Sectors Benefit), Futures are modestly lower as markets digest the recent rally following a quiet night of news. Today focus will remain on the Fed as we get multiple Fed speakers, highlighted by Fed Chair Powell (1:00 PM) and Vice Chair Clarida (5:30 PM) and more.

January Economic Breaker Panel Update

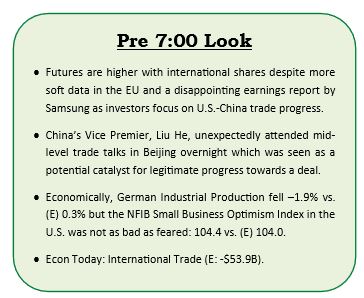

/in Investing/by Tom EssayeSome improvement in the Economic Breaker Panel: Three breakers tripped, January update, futures are cautiously higher this morning mostly thanks to optimism about the US-China trade situation as “mid-level” meetings concluded in Beijing overnight, President Trump’s address to the nation last night regarding border security and the government shutdown did not have a material effect on markets and more.

Encouraging Signs from Credit

/in Investing/by Tom EssayeSome encouraging signs from credit, futures are higher with international shares, today, there is one economic report to watch: International Trade (E: -$53.9B) which has been more closely watched since U.S.-China trade tensions first escalated while there are no Fed officials scheduled to speak and more.

Four Keys to a Market Bottom Updated

/in Investing/by Tom EssayeWhat’s in Today’s Report: Four Keys to a Market Bottom – More Progress But Not There Yet Weekly Market Preview Weekly Economic Cheat Sheet Futures are marginally lower following a quiet weekend as markets digest Friday’s big rally. Economic data was mixed overnight as Japanese Composite PMI and German Manufacturers’ Orders missed estimates. However, German […]

Is Gasoline Demand Another Economic Warning Sign?

/in Investing, Reports/by Tom EssayeWhat’s in Today’s Report: Is Gasoline Demand Another Economic Warning Sign?