Economic Data & Inflation: Tom Essaye Quoted in Barron’s

Economic Data & Inflation: Tom Essaye Quoted in Barron’s

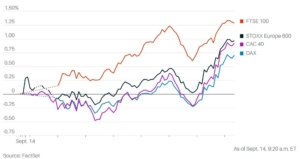

Stock Markets Pause Ahead of Next Week’s Fed Decision

Firstly, “Today focus will be on economic data and if data is ‘Goldilocks’ like we saw on Thursday, expect a continuation of yesterday’s rally.” “Conversely, if the data shows inflation hot or growth slowing, don’t be surprised if markets give back most of yesterday’s rally,” writes Sevens Report Research’s Tom Essaye.

The United Auto Workers also began a partial strike on Friday. Uncertainty surrounding the impact of the strike could weigh on markets.

Also, click here to view the full Barron’s article published on September 15th, 2023. However, to see Tom’s full comments on economic data & inflation sign up here.

If you want research that comes with no long term commitment, yet provides independent, value added, plain English analysis of complex macro topics, then begin your Sevens Report subscription today by clicking here.

To strengthen your market knowledge take a free trial of The Sevens Report.

Join hundreds of advisors from huge brokerage firms like Morgan Stanley, Merrill Lynch, Wells Fargo Advisors, Raymond James, and more! To start your quarterly subscription and see how The Sevens Report can help you grow your business, click here.