A Historic Week Finally Arrives

What’s in Today’s Report:

- A Historic Week Finally Arrives

- Weekly Market Preview: This is a week full of potential catalysts including: The election, the FOMC decision, the jobs report, a potential vaccine announcement, and more QE from the BOE.

- Weekly Economic Cheat Sheet: Jobs Report (Friday) is the key this week.

Futures are more than 1% higher following a generally quiet weekend as markets bounce ahead of a week full of potential catalysts.

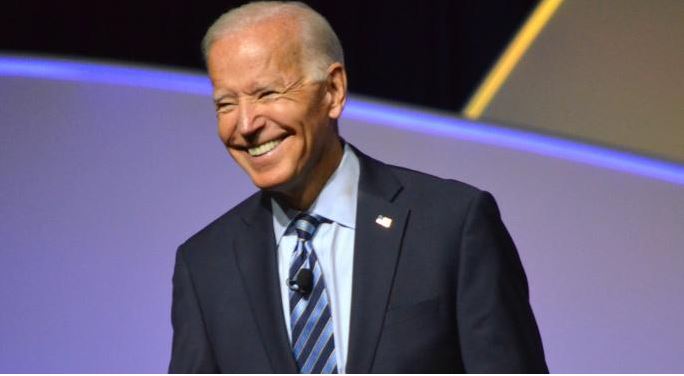

Politically, Biden maintains a wide lead nationally but polls have tightened in some key swing states (FL/AZ/IA). But, markets do still expect the “Blue Wave” final result.

Economic data was solid was Chinese, EU and UK manufacturing PMIs all beat estimates (and remained above 50).

Today we do get one important economic report, the October ISM Manufacturing PMI (E: 55.7), but that shouldn’t move markets unless is a big negative surprise. Instead, we’ll start to get headlines and whispers about how the election is shaping up (early voting totals, etc.) and those headlines are likely to move markets today and tomorrow. So, don’t be surprised if markets get volatile today and tomorrow, but keep in mind almost all of it will be trading “noise.”