Why are Treasury Yields Breaking Out?

What’s in Today’s Report:

- Why Are Treasury Yields Breaking Out (And Cyclical Sectors Outperforming?)

- Weekly EIA Report and Oil Update

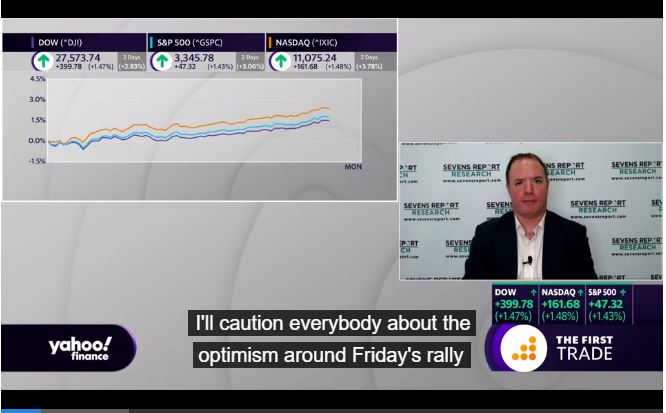

Futures are modestly higher mostly on momentum from yesterday’s rally, following a quiet night of news.

The Vice Presidential debate was traditional and didn’t provide any surprises and won’t impact the Presidential race. Currently the market is fully expecting a Biden win and partially pricing in a “Blue Wave” in November.

Economically, German exports slightly beat estimates, rising 2.4% vs. (E) 1.5%, but that number isn’t moving markets.

Today focus will remain on chatter of any potential stand-alone stimulus bills for the airlines or direct payments to citizens, but nothing is expected. Beyond stimulus, we do get an important economic report via Jobless Claims (E: 819K), and markets will want to see continued improvement to show the recovery is indeed ongoing. A drop below 800k would be positive surprise.

Finally, there are multiple Fed speakers today including Rosengren (12:10 p.m. ET), Kaplan (1:00 p.m. ET), Bostic (2:00 p.m. ET) and Barkin (2:30 p.m. ET), but none of them should move markets.