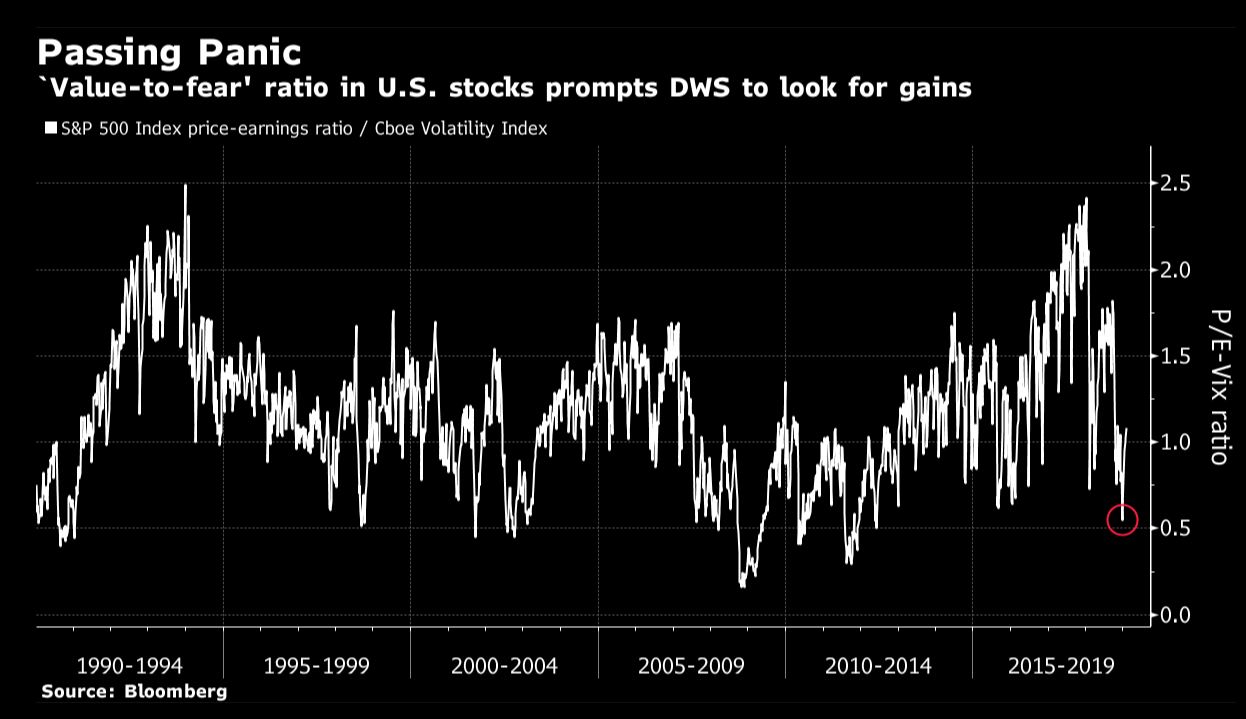

Is a Fed “Pause” Actually Good for Stocks?

What’s in Today’s Report:

- Is a Fed “Pause” Actually Good for Stocks?

Futures are decidedly higher after Congress reached a deal to avert another government shutdown late yesterday and investors remain optimistic about trade talks between the US and China as negotiations in Beijing continue this week.

The NFIB Small Business Optimism Index fell to 101.2 vs. (E) 103 in January underscoring business owners’ uncertain outlook on the economy.

Today, there is one economic report: December JOLTS (E: 6.950M) and several Fed speakers to watch: Powell (12:45 p.m. ET), George (5:30 p.m. ET), and Mester (6:30 p.m. ET).

As long as Powell does not change his recent narrative when he speaks over the lunch hour, investors will likely remain focused on additional updates regarding the new funding deal lawmakers agreed to late Monday and more importantly, the ongoing trade talks in Beijing.