Tom Essaye Quoted in Bloomberg on April 21, 2019

/in Investing/by Customer ServiceWhat would it take the push the market to new all-time highs? Tom Essaye quoted on Bloomberg to share his view on the market, U.S. – China trade, Fed and more. Read the full article here.

Why Average Inflation Matters

/in Investing/by Tom EssayeWhat’s in Today’s Report:

- Why Average Inflation Matters to You

Stock futures are slightly lower this morning after a quiet night of news. There were no economic releases overnight leaving investor focus primarily on earnings.

Oil is notably hitting fresh 2019 highs this morning which should continue to drive outperformance in the energy sector today.

Looking to the calendar for today, there is one economic report due out of Europe: Eurozone Consumer Confidence Flash (E: -6.9) and two reports on the U.S. housing market: FHFA House Price Index (E: 0.4%) and New Home Sales (E: 645K). There are no Fed speakers today.

Additionally, price action in stocks has been especially sensitive to the bond market since the March Fed meeting and while volatility has eased in both markets, there is a 2 Year Treasury Note Auction at 1:00 p.m. ET that could move markets.

Investors’ primary focus however will remain on earnings. Some notable releases today include: TWTR ($0.15), KO ($0.46), PG ($1.04), SNAP ($0.12), and EBAY ($0.63).

Tom Essaye Appeared on Yahoo Finance’s Ticker on April 22, 2019

/in Investing/by Customer ServiceWhat to make up of this earnings season? Tom Essaye shares his view on the market and more with Yahoo Finance’s Seana Smith. Watch the full clip here.

Time to Buy Puts?

/in Investing/by Tom EssayeWhat’s in Today’s Report:

- Time to Buy Puts?

- Weekly Market Preview (All About Earnings)

- Weekly Market Cheat Sheet (GDP Friday is the Key Report)

Futures are modestly lower thanks to higher oil and new concerns about the longevity of Chinese economic stimulus.

The South China Morning Post released an article saying Chinese officials will again focus on structural economic reforms, which means limited future economic stimulus.

Oil is 2% higher following reports the Trump administration will not renew any Iranian import wavers.

Today there is only one economic report, Existing Home Sales (E: 5.30M), and that won’t move markets.

So, the key to trading today will be earnings, and here are the reports we’re watching: HAL ($0.23), KMB ($1.54), WHR ($3.04).

Tom Essaye Quoted in MarketWatch on April 17, 2019

/in Investing/by Customer ServiceWhat is the health-care sector doing these days. Tom Essaye quoted in MarketWatch on April 17, 2019. He talks about this topic, earnings season and more. Read the full article here.

Tom Essaye Interviewed with TD Ameritrade on April 16, 2019

/in Investing/by Customer Service“If this market’s going to continue to rally, it’s going to be led by those cyclical sectors.” Tom talks about the market, the earnings season, banks and more. Watch the full video here.

Is Healthcare A Buy? (It’s Negative YTD)

/in Investing/by Tom EssayeWhat’s in Today’s Report:

- Why Stocks Faded At the Open Yesterday (For the Second Straight Day)

- Is Healthcare a Buy? (XLV is lagging the S&P 500 by 16% YTD)

- Oil and Energy Update

Futures are slightly lower following a night of mixed economic data.

EU flash composite PMIs missed estimates (51.3 vs. (E) 51.8) and that’s a disappointment given recent stabilization in China. But, not all the data was bad as UK Retail Sales rose 1.1% vs. (E) 0.2%, likely on Britons stocking up goods ahead of the hard Brexit deadline in late March.

Today is the eve of a three day weekend but it’s going to be busy as we get a lot of economic data and important earnings.

Important data today includes (in order of importance): PMI Composite Flash (E: 54.3), Retail Sales (E: 0.8%), Philly Fed (E: 10.2) and Jobless Claims (E: 206K). As we said in Monday’s report, the stronger the data, the better for stocks as there is no inflation threat right now (so good data won’t make the Fed hawkish).

On the earnings front, some releases we’ll be watching include: AXP ($2.00), PM ($1.00), SLB ($0.30) and HON ($1.83).

Sevens Report – What’s in the Box?

/in Investing/by Tom EssayeWhat’s in Today’s Report:

- A Warning Sign from Box Shipments?

- Gold Breakdown

Futures are climbing higher this morning while international shares were little changed overnight as investors digested upbeat Chinese economic data against mixed earnings.

Chinese Industrial Production (8.5% vs. E: 6.0%), and Retail Sales (8.7% vs. E: 8.3%) both handily beat expectations in March helping Q1 GDP rise 6.4% vs. (E) 6.3%. But, stabilizing Chinese growth is largely priced in to the market at current levels which is why the reaction has been largely muted by international traders.

Looking to today’s calendar, there is one economic report to watch: International Trade (E: -$53.6B) and two Fed officials are scheduled to speak: Bullard (12:30 p.m. ET) and Harker (12:30 p.m. ET).

The main focus however will remain earnings. A few notables to watch include: MS ($1.17), PEP ($0.92) before the open and AA ($0.17) after the close.

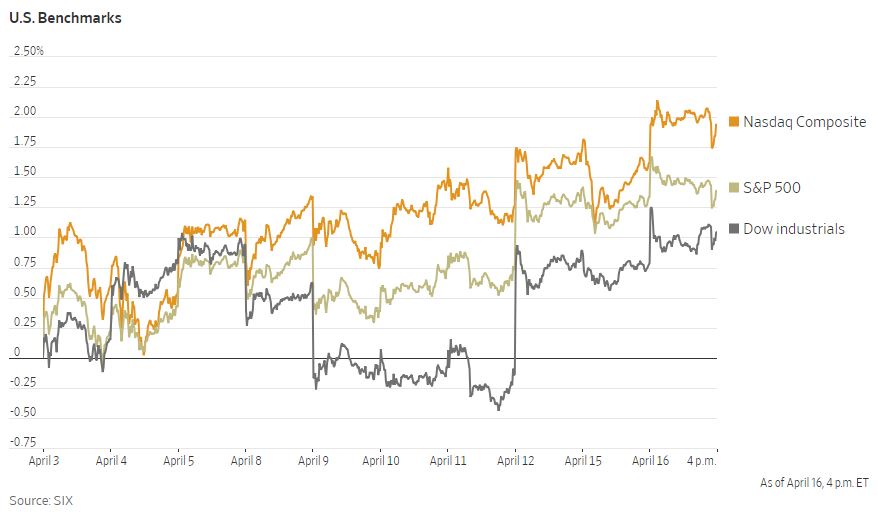

Tom Essaye Quoted in The Wall Street Journal on April 16, 2019

/in Investing/by Customer ServiceHealth care—the best-performing sector last year—is the worst-performing group in the S&P 500 this year. “The jury is still out on health care, earnings season isn’t going to provide enough clarity to…” Click here to read the full article.